U.S. Steel Merchant Final Imports

Merchant final imports to the U.S. were down 5.2% year to date (YTD), year on year (y/y), totaling 437,115 tons for the ten months ending October 2017. October merchant imports came in at 30,515 tons, 30.4% less than the 43,712 ton YTD average volume.

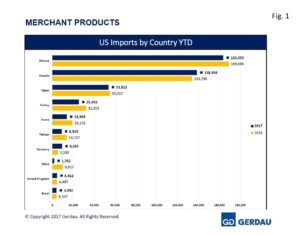

Figure 1 charts the largest exporting countries in rank order on a YTD basis through October for both 2016 and 2017. Mexico and Canada combined account for 69% of the total, up from 66% YTD 2016. Mexico was the largest exporter with 163,650 tons, down 3.2% YTD y/y. October’s volume at 9,433 tons, was 42.7% lower than its 16,465 ton YTD average volume. Canada sent 138,456 tons to the U.S. YTD, up 3.5% y/y. October exports were 12,468 tons, 9.9% less than the 13,846 ton YTD average.

Figure 1 charts the largest exporting countries in rank order on a YTD basis through October for both 2016 and 2017. Mexico and Canada combined account for 69% of the total, up from 66% YTD 2016. Mexico was the largest exporter with 163,650 tons, down 3.2% YTD y/y. October’s volume at 9,433 tons, was 42.7% lower than its 16,465 ton YTD average volume. Canada sent 138,456 tons to the U.S. YTD, up 3.5% y/y. October exports were 12,468 tons, 9.9% less than the 13,846 ton YTD average.

Japan ranked third YTD with 53,813 tons, off 2.2% YTD y/y. For the month of October, Japanese exports were 3,506 tons, 34.8% less than its YTD average of 5,381 tons. Turkey sent 25,433 tons of merchants to the U.S., off 21.1% YTD y/y. October volume was 1,148 tons, down 54.9% compared to its 2,543 ton YTD average volume. Korea exported 13,903 tons YTD, falling 27.3% y/y. October volume came in at 1,619 tons, 16.5% greater than its January to October average volume of 1,390 tons. Germany exported a total of 9,364 tons YTD to the U.S., 75.7% more than last year. German merchant exports in October were 398 tons, 57.5% lower than its YTD average volume of 936 tons. Taiwan sent 8,919 tons of merchant to the U.S. YTD 2017, down 35.0% y/y. For the month, Taiwan exported just 9 tons, well off its 892 ton YTD average.

The United Kingdom’s YTD volume of merchant exports to the U.S. was 4,462 tons, 0.5% less than YTD 2016. October’s exports were 137 tons, 69.3% lower than its average of 446 tons. Brazil sent 3,992 tons of merchant products to the U.S. YTD, off 2.8% y/y. Brazil exported 72 tons of merchant to the U.S. in October after zero tons in August and September. South Africa was back in the U.S. merchant export business in October with 1,528 tons. South Africa’s YTD total was 3,375 tons having shipped in only three months in 2017. Year on year volume was up 343%. The Czech Republic exported 2,368 tons of merchants to the U.S. through October, up 75.4% y/y. The Czech Republic has not sent any merchant tons since June. Spain was the next largest with 2,120 tons, down 48.5% YTD y/y. Volume for the October was just 5 tons after 2 tons in September and 25 tons in August, well off the pace of its YTD average of 212 tons per month.

These twelve countries account for 98.3% of the total merchant intake. There were 16 other countries that exported a combined 7,257 tons of merchants YTD 2017. Year to date 2016 the same 16 country’s exported more than twice as much totaling 17,831 tons.

Laredo Texas was the largest receiving port, offloading 111,078 tons YTD, down 1.8% YTD y/y. October intake was 5,758 tons. Detroit held the number two spot with 92,324 tons, up 0.7% YTD y/y. October exports were 8,926 tons. New Orleans ranked third with 37,661 tons falling 4.6% YTD y/y. October intake was 3,475 tons. Houston/Galveston was the next largest port bringing in 29,928 tons YTD up 9.3% YTD y/y. October intake was 1,213 tons. San Diego, received 28,443 tons, down 9.2% YTD y/y. October intake was 1,440 tons.

Buffalo took-in 24,525 tons, up 3.4% YTD y/y. Intake in October was 1,892 tons. El Paso was the 7th largest receiver of U.S. merchants with 23,019 tons, down 5.4% YTD y/y. October intake was 2,076 tons. Los Angeles offloaded 19,799 tons, down 25.9% YTD y/y. October intake was 704 tons. Savannah was next with 15,841 tons, lower by 27.4% YTD y/y. October receipts totaled 1,384 tons. Rounding-out the top 10 was Ogdensburg NY, bringing in 13,254 tons, up 28.4% YTD y/y. October intake was 1,327 tons.

Twenty-five additional ports combined to receive 41,252 tons of merchant imports thus far in 2017, 9.4% of the total volume YTD. The same 24 ports took-in 47,227 tons YTD 2016, +10.2% of the YTD total.

At Gerdau we closely follow trade in long products steel since it has a profound impact on domestic market share and material pricing. We want you, our valued customers to have access to current information that can help you better plan and operate your businesses.