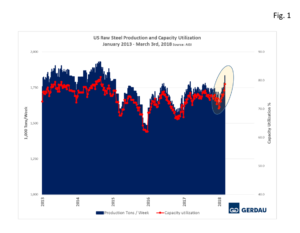

U.S. Steel Capacity Utilization

The total tonnage for the week ending March 3rd was 1,834 million tons, (Mt) at a capacity utilization rate of 78.7%. This was the highest capacity utilization rate since the week of September 20, 2014 and can be attributed to the pending 25% steel tariff proposed by president Trump. For the first nine weeks of 2018, total tonnage output was 15,620 Mt, at a capacity utilization rate of 73.3%. In 2017, the same nine weeks production total was 15,596 Mt at 73.1%.

Figure 1 shows production on the left-hand scale and capacity utilization as a percent on the right-hand scale. After a slow start to the year, capacity utilization has since ramped up nicely over the past few weeks. Week on week production growth is up 2.9%, month on month production growth is up 5.0% and year on year production growth is up 4.2%,

Figure 1 shows production on the left-hand scale and capacity utilization as a percent on the right-hand scale. After a slow start to the year, capacity utilization has since ramped up nicely over the past few weeks. Week on week production growth is up 2.9%, month on month production growth is up 5.0% and year on year production growth is up 4.2%,

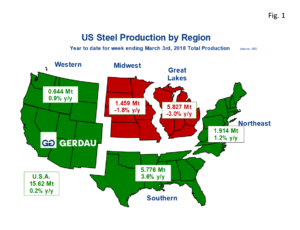

Figure 2  presents a map of the U.S. with its five steel producing zones. The nation as a whole produced 0.2% more steel than for the same period ending March 3rd in 2017. Two regions have “turned green” since our last report on February 10th, (Southern and Northeast). The Great Lakes region was the largest steel producing region, with 5.827 Mt through March 3rd, down 3.0% y/y. The Southern region was a close second with 5.776 Mt up 3.6% y/y. At 1.914 Mt, the Northeast region ranked third largest. The Northeast tonnage increased by 1.2% y/y. The Midwest produced 1.459 Mt, down 1.8% y/y, while the Western zone produced 0.644 Mt, up 0.9% y/y.

presents a map of the U.S. with its five steel producing zones. The nation as a whole produced 0.2% more steel than for the same period ending March 3rd in 2017. Two regions have “turned green” since our last report on February 10th, (Southern and Northeast). The Great Lakes region was the largest steel producing region, with 5.827 Mt through March 3rd, down 3.0% y/y. The Southern region was a close second with 5.776 Mt up 3.6% y/y. At 1.914 Mt, the Northeast region ranked third largest. The Northeast tonnage increased by 1.2% y/y. The Midwest produced 1.459 Mt, down 1.8% y/y, while the Western zone produced 0.644 Mt, up 0.9% y/y.

Looking at production on a twelve month moving total, (12MMT) basis, we see that; The Great Lakes region produced 34,044 Mt, up 0.2% y/y. The Southern zone made 32,936 Mt, up 8.5% y/y. The Northeast region produced 10,755 Mt for a 2.2% increase y/y. The Midwest generated 8,546 Mt, down 1.6% y/y. The Western region produced 3,849 Mt, 1.4% lower on a y/y basis. Total U.S. production, (12MMT) was 90,130 Mt, up 3.1% y/y.

At Gerdau, we track US steel production and capacity utilization to keep an eye on the overall health of the US steel industry. We feel it is important to understand the forces that influence steel demand to include the strength of the U.S. economy and import penetration.