U.S. Steel Capacity Utilization

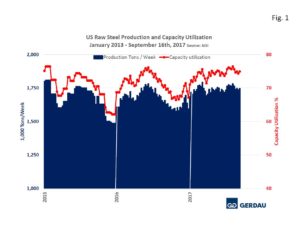

U.S. steel production average capacity utilization rate came in at 74.9% over the past week ending September 16th, up 0.6 percentage points over the previous week. On a four moving average, (4WMA) basis, the capacity utilization rate was slightly less at 74.7%. The 4WMA tonnage for the four weeks ending September 16th was 1,741 million tons, (Mt), 6.2% greater than for the same period last year. Production volume this week, was 66.9% higher than the 800 Mt low point reached Christmas week 2008.

Figure 1 shows production on the left-hand scale and capacity utilization as a percent on the right-hand scale. Production and capacity utilization have been trending higher so far in 2017.

Figure 1 shows production on the left-hand scale and capacity utilization as a percent on the right-hand scale. Production and capacity utilization have been trending higher so far in 2017.

Production year to date, (YTD) was 64,378 Mt, at an average of 1,740 Mt per week with an average capacity utilization of 74.2%. Over the same 37 week period in 2016, the YTD total was 62,651 at an average of 1,693 Mt per week with an average capacity utilization of 72.4%. Summarizing the YTD year over year, (y/y) improvement: +48,675 tons per week, +1.73 Mt total tons, and +1.8 percentage point increase in the capacity utilization rate.

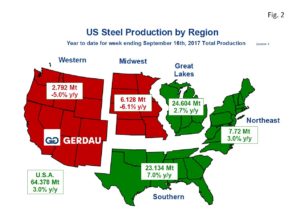

Figure 2 presents a map of the US with the five steel producing zones. The Great Lakes produced the most steel, with 24.60 Mt, YTD, up 2.7% y/y. The Southern region was a close second with 23.13 Mt YTD up 7.0% y/y. Coming in at 7.72 Mt YTD, the Northeast tonnage increased by 3.0% YTD y/y. The Midwest and Western zones both produced less steel YTD compared to the same timeframe a year ago. The Midwest produced 5.13 Mt YTD, down 6.1% y/y, while the West produced 2.79 Mt YTD down 5.0% y/y.

presents a map of the US with the five steel producing zones. The Great Lakes produced the most steel, with 24.60 Mt, YTD, up 2.7% y/y. The Southern region was a close second with 23.13 Mt YTD up 7.0% y/y. Coming in at 7.72 Mt YTD, the Northeast tonnage increased by 3.0% YTD y/y. The Midwest and Western zones both produced less steel YTD compared to the same timeframe a year ago. The Midwest produced 5.13 Mt YTD, down 6.1% y/y, while the West produced 2.79 Mt YTD down 5.0% y/y.

Examining the production statistics on a 3 month moving total (3MMT), y/y basis, helps smooth out m/m volatility. Nationally the 3MMT y/y was up 1.2%. The Great Lakes recorded the highest percentage change with +3.0%, 3MMT y/y, followed by the Northeast, up 1.8%. The Southern zone recorded a modest gain of 0.4%, 3MMT y/y. The Midwest tonnage declined by 1.1% while the Western zone saw its production fall by 5.3%, 3MMT y/y.

Overall this week’s AISI raw steel production and capacity utilization report was encouraging.

At Gerdau, we track US steel production and capacity utilization to keep an eye on the overall health of the US steel industry. We feel it is important to understand the forces that influence steel demand to include the strength of the US economy and import penetration.