U.S. Reinforcing Steel Import Licenses

Rebar licenses year to date, (YTD) through May 28th totaled 654,915 tons, 15.5% lower than the YTD 2017 level of 775,449 tons. So far in May, 110,321 tons have been licensed, 28% of it from Italy.

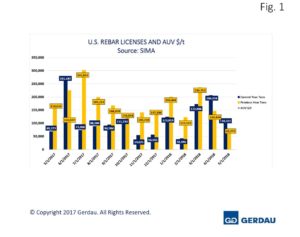

Figure 1 shows the monthly total rebar licenses from June 2017 through May 2018 as well as the corresponding month the year prior. The date is reported by the Steel Import Monitoring System (SIMA).

Figure 1 shows the monthly total rebar licenses from June 2017 through May 2018 as well as the corresponding month the year prior. The date is reported by the Steel Import Monitoring System (SIMA).

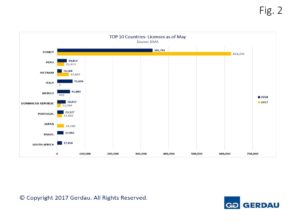

Figure 2  charts rebar licenses the YTD total through May 28th by country along with 2017 YTD total through March. Year to date, Turkey’s license requests totaled 341,793 tons down 45% from the 623,243 ton total YTD 2017. Turkish material accounted for 52% of all rebar licenses YTD.

charts rebar licenses the YTD total through May 28th by country along with 2017 YTD total through March. Year to date, Turkey’s license requests totaled 341,793 tons down 45% from the 623,243 ton total YTD 2017. Turkish material accounted for 52% of all rebar licenses YTD.

Taking a look at the other exporter’s total licensed tonnages totals, we see that Japan exited the rebar market thus far in 2018 after bringing in 24,169 tons YTD 2017. The Dominican Republic’s stepped-up its license volume to 30,843 tons YTD 2018, nearly double its YTD 2017 volume of 12,788 tons. Peru’s 2017 YTD rebar licenses tonnage was 25,473, and 34,813 tons so far in 2018. Mexico has jumped back into the U.S. rebar market, licensing 45,880 tons YTD. Mexico licensed just 832 tons YTD 2017. Brazil requested 22.983 licensed tons YTD, up from zero YTD 2017. South Africa has entered the rebar market with 17,458 tons YTD, compared to 0 tons this time last year.

The average $AUV per ton month to date in May is $564, up $42 from the $AUV in April18.

At Gerdau we closely follow trade in long products steel since it has a profound impact on domestic market share and material pricing. We want you, our valued customers to have access to current information that can help you better plan and operate your businesses.