U.S. Reinforcing Steel Import Licenses

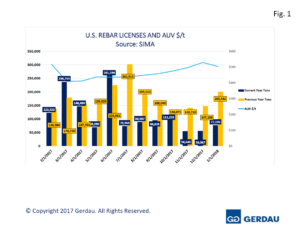

Rebar licenses through January 11th totaled 77,193 tons, well down, (91.5%) from the January 2016 level of 200,442 tons. Straight lengths accounts for all of rebar licensed import thus far this month. Overall rebar import licensed tons in 2017 were lower than in 2016. The 2016 total was 2.142 million, (M), 0.625M or 29.2% greater than the 1.517M level in 2017.

Figure 1 shows the monthly total Rebar licenses for both 2016 and 2017, (and January 2018) as reported by the Steel Import Monitoring System (SIMA).

Figure 1 shows the monthly total Rebar licenses for both 2016 and 2017, (and January 2018) as reported by the Steel Import Monitoring System (SIMA).

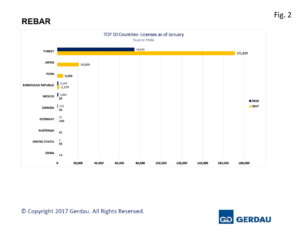

Figure 2  charts rebar licenses through January 11th for 2018, along with January 2017 by country.

charts rebar licenses through January 11th for 2018, along with January 2017 by country.

For January to date, Turkey’s license requests totaled 74,426 tons down from 171,325 tons from January 2017, (-56.6%). For the calendar year 2017, Turkey’s licensed 0.891M tons of rebar. For 2016, the total was 1.514M The year on year, (y/y) differential was 0.622M tons or 41.1%. In 2017, Turkish material YTD accounted for 58.8% of all rebar licenses, down substantially from the 70.7% ratio in 2016. The only other countries with license requests thus far in January were the Dominion Republic with 1,144 tons and Mexico with 1,083 tons.

Taking a look at the remaining exporter’s total licensed tonnages for 2016 and 2017 totals, we see that Japan with 24,169 tons of licenses for 2017 was down 91.7% from its 2016 level of 289,822 tons. Japan appears to have withdrawn from the market as it has not requested any licenses since February 2017. Taiwan licensed 13,352 rebar tons for U.S. consumption in 2017, tumbling 90.8% y/y from the 144,509 tons licensed in 2016. Taiwan has not request any licensed tonnage since July. Portugal was the next largest exporter with 107,338 tons in 2017, a 20-fold increase from its 2016 level of 4,344 tons. Spain’s total licensed tonnage in 2017 totaled 97,547 tons. In 2016 Spain’s license total was 3,930 tons.

Brazil requested 75,787 licensed tons in 2017, 218% higher than its 23,819 tons in 2016. Vietnam’s total for 2017 was 61,627 tons of licenses. Peru requested 52,113 tons in 2017, double its YTD 2016 volume of 25,921. Italy licensed a total of 56,283 tons YTD in 2017, Italy did not export any, (2 tons) of rebar to the U.S. in 2016. The Dominican Republic’s 2017 total was 31,491 tons, a 36% increase from the 23,160 tons it sent to the U.S. in 2016. Russia’s 2017 license total was 16,395 tons, down 57.4% from its 2016 total of 38,501 tons. Mexico had a total of 28,039 tons of in 2017, up six-fold from the 4,072 ton total in 2016. Canada licensed 18,728 tons of rebar in 2017, compared to 10,790 tons in 2016, a 73.6% y/y increase.

Nineteen additional country’s combined for a total of 41,595 licensed tons in 2017, vs. 36,155 tons for the same group of countries in 2016.

At Gerdau we closely follow trade in long products steel since it has a profound impact on domestic market share and material pricing. We want you, our valued customers to have access to current information that can help you better plan and operate your businesses.