U.S. Reinforcing Steel Final Imports

Rebar final imports to the U.S. were down 25.8% year on year (y/y), totaling 1,566,308 tons for the 12 months ending December 2017. December rebar imports were 52,791 tons, 59.6% lower than the average of 130,526 tons. Straight length rebar accounted for 93.3% of the total imports, “other rebar”, 5.4% and coiled rebar, 1.3%.

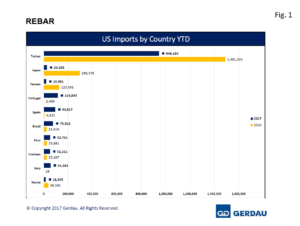

Figure 1 charts the largest exporting countries in rank order on for both 2016 and 2017. Turkey is by far the largest exporter at 946,184 tons, down 36.5% y/y from the 1,491,203 ton volume in 2016. Turkish imports accounted for 60.4% of the total in 2017, down 10.2 percentage points from the 70.6% recorded for all of 2016. Turkey did not export any tons in either November or December.

Figure 1 charts the largest exporting countries in rank order on for both 2016 and 2017. Turkey is by far the largest exporter at 946,184 tons, down 36.5% y/y from the 1,491,203 ton volume in 2016. Turkish imports accounted for 60.4% of the total in 2017, down 10.2 percentage points from the 70.6% recorded for all of 2016. Turkey did not export any tons in either November or December.

Portugal was the second largest exporter with 114,845 tons in 2017, up from just 2,490 tons in 2016. Portugal jumped back in the market in December with 18,722 tons of U.S. exports. This after not exported any rebar tons since August. Spain exported 94,017 tons of rebar to the U.S. in 2017, a 1,387% y/y increase. Spain sent 6,344 tons in December after a 36,773 ton shipment in November.

Brazil brought-in 75,812 tons of rebar to the U.S. market, an increase of 218% y/y. December’s volume was 11,054 tons. Italy was an active rebar exporter from June through September, shipping 56,343 tons YTD up from just 19 tons in 2016. Italy’s December shipments was just 46 tons on the heels of a 20 ton shipment in November. Peru ranked sixth largest for rebar exports with a 12 month total of 52,761 tons, up 104% y/y. Peru only exported rebar tons to the U.S. in three months in 2017, February, June and October. Vietnam sent 52,211 tons in 2017, up 108% from 25,107 tons in 2016. Vietnam has not exported any rebar to the U.S, since September.

The Dominican Republic with 28,016 tons, was up 26.1% y/y. December tonnage was 2,892 tons, 23.9% more than its 2,335 ton YTD average. Mexico exported 27,605 tons of rebar to the U.S. in 2017, +618% y/y. December volume was 8,275 tons, 260% greater than its 2017 average of 2,300 tons. Japan exported 26,635 tons, down 91.0% y/y. In 2016, Japan had exported 295,775 tons of rebar to the U.S. Japan has not exported any rebar tons since February of this year. Taiwan sent 19,991 tons of rebar to the U.S. through December of this year, 84.3% less than for the same period last year. Taiwan has not exported any tons over the last five months, after sending 9,558 tons in July and 8,815 tons in June. Canada exported 18,527 tons of rebar to the U.S. in 2017, 65.2% more than last year. December volume was 1,588 tons, close to its average of 1,544 tons for the year. Russia’s rebar export total was 16,395 tons in 2017, off 57.4% y/y. All 16,395 tons shipped in August.

There were 16 additional countries that exported rebar to the U.S. in 2017. The combined total was 28,459 tons or 1.8% of the total. The 17 country total for 2016 was 19,513 tons, 0.9% of the total.

Houston/Galveston was the port that took in the most tons, 36.5% of total shipments in 2017. The total for the year was 589,878, down 23.3% y/y. December volume was zero tons. New Orleans offloaded 258,976 tons, down 15.1% y/y. December volume was 11,051 tons. Philadelphia landed 191,539 tons, falling 9.1% y/y. December volume was 26,447 tons. Miami was the next largest port bringing in 185,302 tons, down 40.5% y/y. December tons were zero.

Tampa saw a 4.7% y/y increase, receiving 61,477 tons in 2017. Tampa took-in 3,322 tons in December after not taking-in any tons for the four months prior. Boston received 60,999 tons of rebar in 2017, up 29.7% y/y. Boston has not received any tons of rebar since September. San Juan PR offloaded 58,429 tons, a decrease of 23.0%, y/y. San Juan PR offloaded 2,892 tons in December. San Francisco landed 44,543 tons in 2017, down 70.1% y/y. December volume was just 20 tons.

Baltimore was next with 38,306 tons, falling 30.7% YTD y/y. December’s volume was zero tons. Los Angeles ranked 10th with 23,497 tons, plummeting 74.5% y/y. Los Angeles brought-in six tons in December after four months in a row of zero tonnage.

Seventeen additional ports combined to offload 53,342 tons of rebar in 2017, 3.3% of total rebar imports. In 2016, the same 17 ports offloaded 24,742 tons, or 1.3% of the total.

At Gerdau we closely follow trade in long products steel since it has a profound impact on domestic market share and material pricing. We want you, our valued customers to have access to current information that can help you better plan and operate your businesses.