U.S. Reinforcing Steel Final Imports

Rebar final imports to the US were down 23.1% year to date (YTD), year on year (y/y), totaling 1,513,517 tons for the eleven months ending November 2017. November rebar imports were 60,304 tons, 56.2% lower than the YTD average of 137,592 tons. Straight length rebar accounted for 93.3% of the total imports YTD, “other rebar”, 5.4% and coiled rebar, 1.3%.

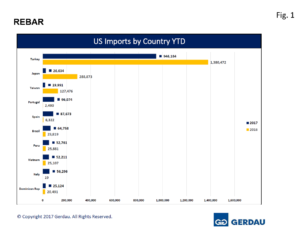

Figure 1 charts the largest exporting countries in rank order on a YTD basis through November for both 2016 and 2017. Turkey is by far the largest exporter at 946,184 tons, down 31.4% YTD y/y. Turkish imports account for 62.5% of the total thus far in 2017, down 8.3 percentage points from the 70.8% recorded for all of 2016. Turkish did not export any tons in November.

Figure 1 charts the largest exporting countries in rank order on a YTD basis through November for both 2016 and 2017. Turkey is by far the largest exporter at 946,184 tons, down 31.4% YTD y/y. Turkish imports account for 62.5% of the total thus far in 2017, down 8.3 percentage points from the 70.8% recorded for all of 2016. Turkish did not export any tons in November.

Portugal was the second largest exporter with 96,074 tons YTD, up from just 2,490 tons YTD 2016. Portugal’s has not exported any rebar tons since August. Spain jumped back in the U.S. rebar market with a large 35,014 ton shipment in September, followed by a zero ton month in October, rebounding to 36,773 tons in November. Its YTD total was 87,673 tons. Year to date in 2016, Spain sent 6,322 tons to the U.S. Brazil brought-in 64,758 tons of rebar to the U.S. market, an increase of 172% YTD y/y. November’s rebar volume was 17,309 tons. Italy was an active rebar exporter from June through September, shipping 56,296 tons YTD up from just 19 tons YTD 2016. Italy’s November shipments fell to just 20 tons. Peru ranked sixth largest for rebar exports with a YTD total of 52,761 tons, up 104% y/y. Peru only exported rebar tons to the U.S. in three months in 2017, February, June and October.

Vietnam sent 52,211 tons YTD, up 108% from 25,107 tons YTD in 2016. Vietnam has not exported any rebar to the U.S, since September. Japan exported 26,634 tons, down 90.8% YTD y/y. Through November of last year, Japan had exported 288,873 tons of rebar to the U.S. Japan has not exported any rebar tons since February of this year. The Dominican Republic with 25,124 tons, was up 22.6% YTD y/y. November tonnage was 2,084 tons, 8.8% less than its 2,284 ton YTD average. Taiwan sent 19,991 tons of rebar to the U.S. through November of this year, 84.3% less than for the same period last year. Taiwan has not exported any tons over the last four months, after sending 9,558 tons in July and 8,815 tons in June.

Mexico exported 19,330 tons of rebar to the U.S. YTD, +442% y/y. November volume was 3,096 tons, 76.2% greater than its YTD average of 1,757 tons. Canada exported 16,939 tons of rebar to the U.S. YTD, 52.2% more than for the same period last year. November volume was 525 tons, 65.9% lower than its YTD average of 1,540 tons. Russia’s rebar export total was 16,395 tons YTD. All of it shipped in August. Year to date last year, Russian shipments totaled 22,129 tons.

There were 17 additional countries that exported rebar to the U.S. thus far in 2017. The combined total was 33,147 tons or 2.2% of the total. The 17 country total for November was 498 tons.

Houston/Galveston was the port that took in the most tons, 39.0% of total shipments YTD) with 589,878, down 15.1% YTD y/y. November volume was 29,969 tons. New Orleans offloaded 247,925 tons YTD, off 18.7% y/y. New Orleans took-in 10,655 tons in November. Miami was the next largest port bringing in 185,302 tons YTD, down 33.8% y/y. November tons were 6,804. Philadelphia held the number four spot with 166,092 tons, falling 21.2% YTD y/y. November volume was zero.

Boston ranked 5th largest YTD in 2017 bringing in 60,999 tons, up 29.7%, y/y. Boston has not receive any tons of rebar since September. Tampa saw an 11.6% YTD y/y increase, receiving 58,155 tons YTD. Tampa did not receive any tons over the past four months. San Juan PR offloaded 55,538 tons, a decrease of 8.8%, YTD y/y. It offloaded 3,327 tons in November. San Francisco landed 44,543 tons YTD, down 69.3% y/y. Only 34 tons arrived in October, followed by 98 tons in November. Baltimore was next with 38,306 tons, falling 20.6% YTD y/y. After a four month lull, Baltimore offloaded 5,684 tons in November. Los Angeles ranked 10th with 23,491 tons, plummeting 73.6% YTD y/y. Los Angeles has not taken-in any tons since July.

Seventeen additional ports combined to offload 43,286 tons of rebar YTD 2017, 2.9% of total rebar imports.

At Gerdau we closely follow trade in long products steel since it has a profound impact on domestic market share and material pricing. We want you, our valued customers to have access to current information that can help you better plan and operate your businesses.