U.S. Manufacturing Capacity Utilization

Manufacturing capacity utilization (MCU), came in at 75.4% in July, flat month on month (m/m), up 0.5 percentage point year on year (y/y). Year to date (YTD), MCU has kept to a very narrow range (75.1% to 75.8%), averaging 75.5%.

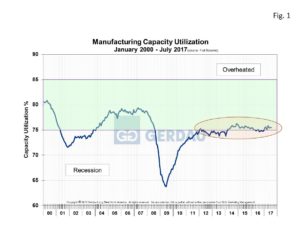

Figure 1, charts capacity utilization from 2010 to present. We are currently in the green zone which is the ideal MFC, albeit current MCU is at the bottom of the range and been range bound for over five years.

Figure 1, charts capacity utilization from 2010 to present. We are currently in the green zone which is the ideal MFC, albeit current MCU is at the bottom of the range and been range bound for over five years.

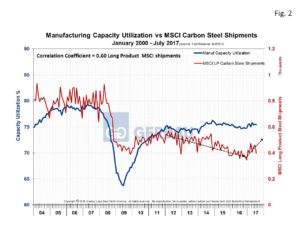

Figure 2  shows the same data in Figure 1 from the year 2004 with the addition of MSCI service long products shipment data on the right-hand Y axis in red. The two data sets are correlated at 0.60 over the entire period shown. A significant portion of long products are consumed in construction. Therefore one might expect that breaking-out bars from total long products would improve the relationship. Surprisingly in doing so, the correlation coefficient only increased by 0.06 point. After the recession ended, MCU rebounded and subsequently plateaued at the 75% level. MCSI shipments on the other hand, drifted lower through the end of 2016. The good news is that beginning in 2017, MSCI service long products shipments have been steadily picked-up.

shows the same data in Figure 1 from the year 2004 with the addition of MSCI service long products shipment data on the right-hand Y axis in red. The two data sets are correlated at 0.60 over the entire period shown. A significant portion of long products are consumed in construction. Therefore one might expect that breaking-out bars from total long products would improve the relationship. Surprisingly in doing so, the correlation coefficient only increased by 0.06 point. After the recession ended, MCU rebounded and subsequently plateaued at the 75% level. MCSI shipments on the other hand, drifted lower through the end of 2016. The good news is that beginning in 2017, MSCI service long products shipments have been steadily picked-up.

The ISM manufacturing index recorded a value of 56.3 for July, with new orders were at 60.4 and production at 60.6, all numbers were solidly in the expansion zone. Manufacturing employment stood at 12.425 million at the end of July, up 16,000 month on month, (+0.13%) and up 134,000 year on year, (+1.09%). The US dollar continues to fall against a basket of currencies. The Euro is at its highest level since early 2015 reaching 1.181 EUR/USD in mid-day trading today. A lower dollar should help U.S. manufacturers increase export sales as well as reduce the attractiveness for exports of goods to the U.S.

At Gerdau we regularly monitor the manufacturing capacity utilization date issued by the Federal Reserve because it provides excellent insight into the health of US manufacturing activity. We know that when manufacturing is performing well, so are steel sales and want to keep you our valued customers and readers informed.