U.S. Infrastructure Spending

Referencing data from the U.S. Census Bureau’s construction put-in-place (CPIP) shows that infrastructure spending, (not seasonally adjusted in constant 2009 dollars) decreased by 3.5% three months year on year, (y/y) to $51.2 billion, (B). On a twelve month y/y comparison, spending was down 1.1% to $172.9. Momentum was negative 2.4%.

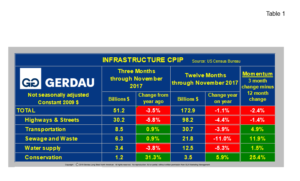

Table 1 presents three month y/y and 12 month y/y data in NSA, constant dollars as well as the percentage change over these two intervals. The column to the far right list momentum which we define as 3 months minus 12 months.

Table 1 presents three month y/y and 12 month y/y data in NSA, constant dollars as well as the percentage change over these two intervals. The column to the far right list momentum which we define as 3 months minus 12 months.

Spending was down in every category on a 12 month y/y basis except for the smallest outlay category, conservation. Conservation recorded growth for both 3 and 12 month y/y comparisons. Conservation spending was higher by 31.3% on a 3MMA basis and up by 5.9% on a 12MMA comparison. Momentum surged to +25.4% on the stronger 3 month expenditure.

By far the largest expenditure category, Highways and streets which includes paving and bridges accounted for 59% of total infrastructure spending over the last 12 months. Spending was down 4.4%, 12 months y/y and a larger 5.8%, 3 months y/y. As a result, momentum for Highways and streets was negative 1.4%.

The second largest spend was for Transportation. It was off 3.9% on a 12 month y/y basis and posted a positive 0.9% on a 3 month y/y comparison resulting in positive momentum of 4.9%. Sewage & Waste spending fell 11.0% over 12 months and also recorded a positive 0.9% over 3 months. The resultant momentum was +11.9%. Water supply was lower by 5.3% for 3 months and down by 3.8% on a 12 month y/y basis. Momentum was positive for Water supply at +1.5%.

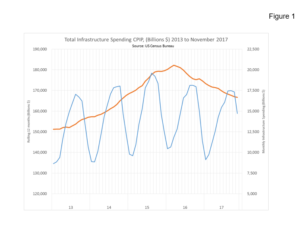

Figure 1 plots total infrastructure spending from 2013 to present on both a monthly and on a 12 month rolling basis. The orange line, (12 month rolling expenditures) clearly illustrates that aggregate spending on infrastructure is trending in sharply downward. On a rolling 12 month basis, spending peaked in March 2016 at $182.2B. November 2017 rolling 12 month infrastructure spending was $172.9B, down $9.3B or -5.1% from the recent peak level.

plots total infrastructure spending from 2013 to present on both a monthly and on a 12 month rolling basis. The orange line, (12 month rolling expenditures) clearly illustrates that aggregate spending on infrastructure is trending in sharply downward. On a rolling 12 month basis, spending peaked in March 2016 at $182.2B. November 2017 rolling 12 month infrastructure spending was $172.9B, down $9.3B or -5.1% from the recent peak level.

The American Society of Civil Engineers, (ASCE) 2017 infrastructure report for America scored an overall “D+”. The best score was for Railroads with a “B”. The worst score was for Transit at “D-“. Airports, Dams, Drinking water, Inland waterways, Levees, and Roads all scored a “D”. Energy, Hazardous waste, Public parks, Schools and Wastewater all scored a “D+”. Bridges, Ports, Solid waste all scored a “C+”. Clearly there is a need for significant infrastructure spending in this country.

After making progress on deregulation and passage of the tax bill the Trump administration will turn its attention to infrastructure along with immigration and national security. According to Bloomberg news, this policy initiative commands widespread support as it: “Promises beneficial effects for both the supply and demand sides of the economy. And it can be funded in a cost-effective manner. Indeed, the question is not the economic or financial desirability of such a program, but its political feasibility. With their control of both houses of Congress, Republicans have a window to move ahead on an infrastructure program as part of a broad pro-growth policy agenda.”

At Gerdau, we regularly monitor spending on infrastructure since it has a huge impact on steel sales, particularly long products, which we produce and market to you our valued customers.