U.S. Beam Import Licenses

Beam licenses through March 13th totaled just 4,300 tons, down 37,128 tons or 89.6% from last March’s total of 41,428 tons. Year to date, (YTD) beam import license volume through March 13th totaled 68,856 ton, vs. 105,008 tons YTD 2017 and 147,163 tons YTD 2016. Thus far in 2018, wide flange beams accounted for 66%, while standard I beams made up the remaining 33%.

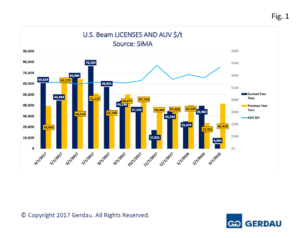

Figure 1 shows the monthly total beam licenses from April 2017 through March 2018 along with the same month from the previous year for comparison. The data was sourced from the Steel Import Monitoring System (SIMA). Beam licenses are off to a slow start in March.

Figure 1 shows the monthly total beam licenses from April 2017 through March 2018 along with the same month from the previous year for comparison. The data was sourced from the Steel Import Monitoring System (SIMA). Beam licenses are off to a slow start in March.

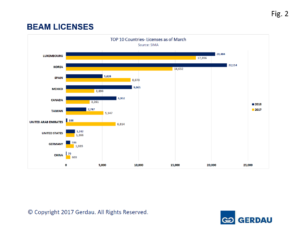

Figure 2 charts beam licenses through March 13th for 2018, along with 2017 by country. Korea licensed 22,114 tons, up 51% from last year’s 14,632 tons. So far in March Korea has only licensed 261 tons, well down from February’s 14,444 tons. Luxembourg licensed 20,484 tons through the 13th of March, down 13% from last year’s 17,856 tons. License volume so far in March totals 1,698 tons. Spain with 5,028 tons YTD was down 43% from last year’s 8,878 tons. License volume so far in March is only 67 tons. Mexico’s licensed 9,065 tons YTD which was 40% higher than last year’s YTD volume of 3,894 tons. Mexico has requested 658 tons of beam licenses so far in March.

charts beam licenses through March 13th for 2018, along with 2017 by country. Korea licensed 22,114 tons, up 51% from last year’s 14,632 tons. So far in March Korea has only licensed 261 tons, well down from February’s 14,444 tons. Luxembourg licensed 20,484 tons through the 13th of March, down 13% from last year’s 17,856 tons. License volume so far in March totals 1,698 tons. Spain with 5,028 tons YTD was down 43% from last year’s 8,878 tons. License volume so far in March is only 67 tons. Mexico’s licensed 9,065 tons YTD which was 40% higher than last year’s YTD volume of 3,894 tons. Mexico has requested 658 tons of beam licenses so far in March.

Canada licensed 6,932 tons YTD, 11% higher than 2017 YTD volume of 3,261 tons. March’s month to date, (MTD) volume was 127 tons through the 13th. Taiwan licensed 2,787 tons YTD, down 46% from last year’s YTD volume of 5,147 tons. Taiwan’s license volume for March was 1,066 tons so far this month. The United Arab Emirates, licensed only 188 tons YTD, a small fraction of the 6,814 tons YTD 2017. The UAE has yet to request any licenses for March. Germany licensed 566 tons YTD, 45% of the volume MTD last year. Germany has requested 293 tons so far this March. China licensed 79 tons YTD, down sharply from 2017 YTD volume of 603 tons.

The average $AUV per ton started the year at $608 per ton, fell to $582 per ton in February, before running up to $669 per ton MTD in March.

At Gerdau we closely follow trade in long products steel since it has a profound impact on domestic market share and material pricing. We want you, our valued customers to have access to current information that can help you better plan and operate your businesses.