U.S. Beam Import Licenses

Beam licenses through January 24th totaled 12,128 tons, down 27,902 tons or 69.7% from last January’s total of 40,030 tons. Overall beam import licensed tons in 2017 were lower than in 2016. The 2016 total was 568,065 tons 26,934 tons or 4.7% less than the 541,131 ton level in 2017. For all of 2017, wide flange beams accounted for 66.8% and standard I beams made up the remaining 33.2% on an annual basis.

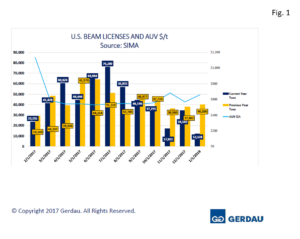

Figure 1 shows the monthly total beam licenses from February 2017 through January 2018 along with the same month from the previous year for comparison. The data was sourced from the Steel Import Monitoring System (SIMA). Beam licenses to date were very light in January vs. recent history.

Figure 1 shows the monthly total beam licenses from February 2017 through January 2018 along with the same month from the previous year for comparison. The data was sourced from the Steel Import Monitoring System (SIMA). Beam licenses to date were very light in January vs. recent history.

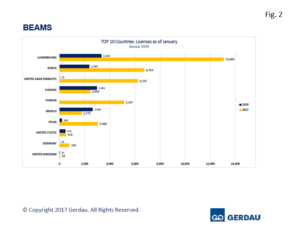

Figure 2 charts beam licenses through January 24th for 2018, along with January 2017 by country. Korea licensed 2,384 tons, down 64.7% from last year’s 6,754 tons. Luxembourg licensed 3,345 tons through the 24th of January, down 74.4% from last year’s 13,084 tons. Spain with 203 tons month to date was well down from last year’s 3,066 tons. Canada licensed 2,981 up 21.4% over January 2017s 2,456 tons. Mexico’s licensed 2,644 tons month to date which was 38.6% higher than last year’s 1,772 ton volume.

charts beam licenses through January 24th for 2018, along with January 2017 by country. Korea licensed 2,384 tons, down 64.7% from last year’s 6,754 tons. Luxembourg licensed 3,345 tons through the 24th of January, down 74.4% from last year’s 13,084 tons. Spain with 203 tons month to date was well down from last year’s 3,066 tons. Canada licensed 2,981 up 21.4% over January 2017s 2,456 tons. Mexico’s licensed 2,644 tons month to date which was 38.6% higher than last year’s 1,772 ton volume.

Taiwan licensed 5,147 tons in January 2017. Month to date, Taiwan’s did not license any tons this month. Similarly the United Arab Emirates, licensed 6,252 tons in January 2017, but just 19 tons month to date this year. Germany was another country with a large reduction in licensed tons, falling from 799 tons in January 2017 to 15 tons month to date this year. China and Brazil each licensed small volumes this month, 14 and 15 tons respectively. Neither country brought in any volume in January 2017. Russia and South Africa each sent small tonnages in January 2017, (63 and 55 tons). Neither country has licensed any tons for the month through the 24th.

The $AUV per ton was relatively flat for most of the year. January 2018 $AUV average was reported at $658 per ton.

At Gerdau we closely follow trade in long products steel since it has a profound impact on domestic market share and material pricing. We want you, our valued customers to have access to current information that can help you better plan and operate your businesses.