Producer Price Index for Construction

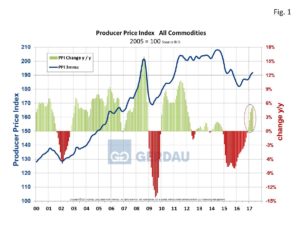

The PPI for all commodities moved up 5.3% year on year (y/y), in April. The index has now increased for five consecutive months with each successive months percentage increase greater than the month before. The material and construction components PPI has increased in each of the last five months and has moved-up on a y/y basis for 10 consecutive months.

Figure 1 examines the three month moving average (3MMA), materials and components PPI for all commodities. The index began declining mid-2014, bottoming-out in March 2016. Since then the trend has been strong to the upside with all econometric indicators pointing to continued higher pricing going forward. The April index 3MMA value was 191.8, the same as the September 2015 reading and the February 2011 posting.

Figure 1 examines the three month moving average (3MMA), materials and components PPI for all commodities. The index began declining mid-2014, bottoming-out in March 2016. Since then the trend has been strong to the upside with all econometric indicators pointing to continued higher pricing going forward. The April index 3MMA value was 191.8, the same as the September 2015 reading and the February 2011 posting.

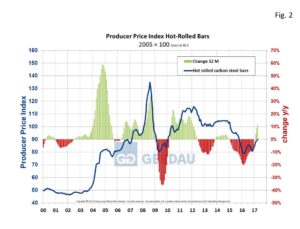

Figure 2 shows the PPI for hot-rolled carbon steel bars, along with the y/y percentage change. It fell throughout 2012, plateaued in 2013, rebounded slightly in 2014 before plateauing once again. In 2015 the PPI for hot-rolled carbon steel bars fell sharply bottoming-out in February of 2015. The PPI for hot-rolled carbon steel bars has now recorded a positive y/y percentage change for three consecutive months in an encouraging trend that will hopefully continue.

It fell throughout 2012, plateaued in 2013, rebounded slightly in 2014 before plateauing once again. In 2015 the PPI for hot-rolled carbon steel bars fell sharply bottoming-out in February of 2015. The PPI for hot-rolled carbon steel bars has now recorded a positive y/y percentage change for three consecutive months in an encouraging trend that will hopefully continue.

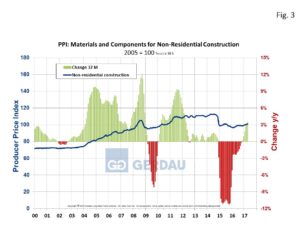

Figure 3 presents the 3MMA PPI chart for non-residential buildings from 2000 to present. After the recession ended the PPI for non-residential buildings rose at a very tepid pace starting at 100 in June 2010 and peaking at 112.4 in August 2014. At that point prices rolled back quite abruptly, falling to 98.7 by January 2015. Year on year percentage changes were negative all though 2015 and most of 2016, before beginning to ascend once again this year. Materials and components for office and warehouse construction PPI has helped move non-residential PPI up. The office construction PPI is up 1.9% y/y and up 3.5% over 24 months, while the PPI for warehouse construction is up 2.1% y/y and up 4.0% over 24 months

Figure 3 presents the 3MMA PPI chart for non-residential buildings from 2000 to present. After the recession ended the PPI for non-residential buildings rose at a very tepid pace starting at 100 in June 2010 and peaking at 112.4 in August 2014. At that point prices rolled back quite abruptly, falling to 98.7 by January 2015. Year on year percentage changes were negative all though 2015 and most of 2016, before beginning to ascend once again this year. Materials and components for office and warehouse construction PPI has helped move non-residential PPI up. The office construction PPI is up 1.9% y/y and up 3.5% over 24 months, while the PPI for warehouse construction is up 2.1% y/y and up 4.0% over 24 months

At Gerdau, we monitor the PPI which is issued monthly from the Bureau of Labor Statistics because our past analysis has led us to believe that the BLS PPI numbers measure-up to real-world pricing. We feel it is important for us and our customers to know where we are pricing-wise relative to history and how we stack-up against competing materials.