Producer Price Index for Construction

The May Bureau of Labor Statistics producer prices index, (PPI), all commodities PPI, rose 1.6% for the highest m/m gain since January 2017. On a 12 month year on year, (y/y) comparison, the all commodities PPI rose 4.3%. Inflation beyond the 2% annual goal by the Federal Reserve will likely result in an interest rate hike later this month.

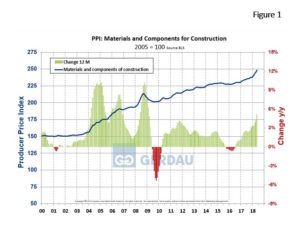

Figure 1 shows the 3MMA, materials and components PPI for construction from 2000 to May 2018. The material and construction components PPI increased by +2.7% over three months, +4.1% over six months, +5.1% over 12 months and by +7.8% over a 24 month interval. On a rolling 12 month basis, the material and construction component PPI has advanced for 19 consecutive months.

Figure 1 shows the 3MMA, materials and components PPI for construction from 2000 to May 2018. The material and construction components PPI increased by +2.7% over three months, +4.1% over six months, +5.1% over 12 months and by +7.8% over a 24 month interval. On a rolling 12 month basis, the material and construction component PPI has advanced for 19 consecutive months.

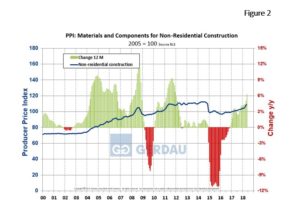

Figure 2  shows the 3MMA, material and components for non-residential construction PPI from 2000 to May 2018. The non-residential construction PPI rose increased by +3.2% over three months, +4.7% over six months, +6.3% over 12 months and by +9.9% over a 24 month timeframe. The non-residential construction PPI has been increasing at faster clip than the overall commodities index over the past 12 months. On a rolling 12 month basis, the material and construction component PPI has increased in each of the past 16 months.

shows the 3MMA, material and components for non-residential construction PPI from 2000 to May 2018. The non-residential construction PPI rose increased by +3.2% over three months, +4.7% over six months, +6.3% over 12 months and by +9.9% over a 24 month timeframe. The non-residential construction PPI has been increasing at faster clip than the overall commodities index over the past 12 months. On a rolling 12 month basis, the material and construction component PPI has increased in each of the past 16 months.

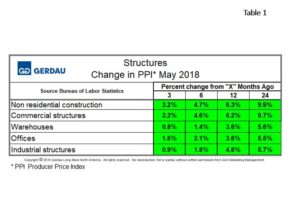

Table 1  charts the PPI of structure types. This is the cost that a contractor would charge to build the building in question. Five types of structures are examined. On a 3 month y/y comparison, Commercial structures have increased in prices by 3.2%, 3 months y/y and were up 6.2% y/y. Warehouse structures increased by 0.8%, 3 months y/y and by 3.6% y/y. Office buildings price of construction were up 1.6% 3 month y/y and by 3.6% over a 12 month period. Industrial structures were up 0.9% on a 3 month y/y comparison, industrial structures increased by 4.8% on a 12 month basis.

charts the PPI of structure types. This is the cost that a contractor would charge to build the building in question. Five types of structures are examined. On a 3 month y/y comparison, Commercial structures have increased in prices by 3.2%, 3 months y/y and were up 6.2% y/y. Warehouse structures increased by 0.8%, 3 months y/y and by 3.6% y/y. Office buildings price of construction were up 1.6% 3 month y/y and by 3.6% over a 12 month period. Industrial structures were up 0.9% on a 3 month y/y comparison, industrial structures increased by 4.8% on a 12 month basis.

At Gerdau, we monitor the PPI which is issued monthly from the Bureau of Labor Statistics because our past analysis has led us to believe that the BLS PPI numbers measure-up to real-world pricing. We feel it is important for us and our customers to know where we are pricing-wise relative to history and how we stack-up against competing materials.