Producer Price Index for Construction

The December Bureau of Labor Statistics producer prices index, (PPI) for all commodities was up 0.3% month on month, (m/m). On a 12 month year on year, (y/y) comparison, the all commodities PPI rose 4.5%. The all commodities index has moved higher in each of the last 13 months on a y/y basis.

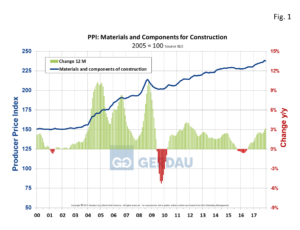

Figure 1 shows the 3MMA, materials and components PPI for construction from 2000 to December 2017. The material and construction components PPI increased by +0.8% over three months, +1.6% over six months, +3.2% over 12 months and by +4.3% over a 24 month interval. On a rolling 12 month basis, the material and construction component PPI has advanced for 18 consecutive months.

Figure 1 shows the 3MMA, materials and components PPI for construction from 2000 to December 2017. The material and construction components PPI increased by +0.8% over three months, +1.6% over six months, +3.2% over 12 months and by +4.3% over a 24 month interval. On a rolling 12 month basis, the material and construction component PPI has advanced for 18 consecutive months.

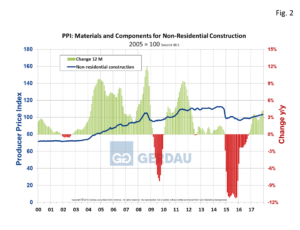

Figure 2 shows the 3MMA, material and components for non-residential construction PPI from 2000 to December 2017. The non-residential construction PPI rose increased by +1.1% over three months, +2.4% over six months, +4.4% over 12 months and by +5.4% over a 24 month timeframe. In a November report from the American General Contractors, it highlights that wallboard is on partial allocation and that buyers expect to see a double digit price hike this month. Other material suppliers have announced significant price hikes to include concrete, steel studs, wire mesh, insulation and flooring products.

shows the 3MMA, material and components for non-residential construction PPI from 2000 to December 2017. The non-residential construction PPI rose increased by +1.1% over three months, +2.4% over six months, +4.4% over 12 months and by +5.4% over a 24 month timeframe. In a November report from the American General Contractors, it highlights that wallboard is on partial allocation and that buyers expect to see a double digit price hike this month. Other material suppliers have announced significant price hikes to include concrete, steel studs, wire mesh, insulation and flooring products.

The non-residential construction PPI has been increasing at faster clip than the overall commodities index over the past 12 months. On a rolling 12 month basis, the material and construction component PPI has increased in each of the past 14 months.

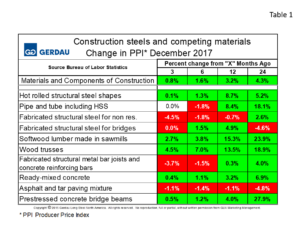

Table 1 charts construction steels and its competing materials. The overall number for all materials and components of construction was up 0.8% over the past three months and up 3.2% y/y. According to the BLS, structural steel shapes prices are moving-up, advancing 1.3% over 3 months and by 8.7% y/y. The PPI for pipe, tube and hollow structural shapes was flat over over 3 months, and was up 8.4% y/y. The PPI for fabricated steel for non-residential construction fell 4.5% over three months and was lower by 0.7% on a 12 month basis.

Table 1 charts construction steels and its competing materials. The overall number for all materials and components of construction was up 0.8% over the past three months and up 3.2% y/y. According to the BLS, structural steel shapes prices are moving-up, advancing 1.3% over 3 months and by 8.7% y/y. The PPI for pipe, tube and hollow structural shapes was flat over over 3 months, and was up 8.4% y/y. The PPI for fabricated steel for non-residential construction fell 4.5% over three months and was lower by 0.7% on a 12 month basis.

Fabricated structural steel for bridges was flat over the last three months and was higher by 4.9% over 12 months. Fabricated bar joist and fabricated rebar, (grouped together in one category) fell 3.7% over 3 months but rose 0.3% on a y/y comparison. Prestressed concrete bridge beams managed a 0.5% gain 3 months y/y and were higher by 4.0% when compared to December of 2016. Compared to 24 months ago, prestressed concrete bridge beams are up 27.9%. Softwood lumber prices are higher by 2.7% over the last 3 months and by 15.3% on a y/y comparison. Wood trusses were also higher in price, up 4.5% and 13.5% for 3 and 12 month comparisons. This indicated that residential construction is gaining strength.

The PPI for non-residential structures moved-up 1.0%, 3 months y/y and by 4.2% on a y/y comparison. Commercial building exhibited the strongest price gains, rising 1.0% over three months and by 4.2% over 12 months and 5.6% over two years. Office structures were flat 3 months y/y and up by 2.1%, 12 months y/y. Industrial structures were also flat 3 months y/y but were up by 1.8%, on a 12 month y/y comparison.

At Gerdau, we monitor the PPI which is issued monthly from the Bureau of Labor Statistics because our past analysis has led us to believe that the BLS PPI numbers measure-up to real-world pricing. We feel it is important for us and our customers to know where we are pricing-wise relative to history and how we stack-up against competing materials.