Producer Price Index for Construction

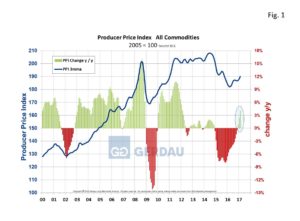

The PPI for all commodities moved up 4.1% year on year (y/y), in February on the heels of a 2.4% increase in January. The index has now increased for months in a row. The material and construction components PPI has increased in each of the last three months and has moved-up on a y/y basis for eight consecutive months.

Figure 1 examines the materials and components PPI for all commodities. The index began declining mid-2014, bottoming-out in March 2016. Since then it has staged a comeback and exhibits a very encouraging trend line. On a y/y percentage change comparison, the all commodities PPI is up three months in a row with an each sequential month higher than the previous.

Figure 1 examines the materials and components PPI for all commodities. The index began declining mid-2014, bottoming-out in March 2016. Since then it has staged a comeback and exhibits a very encouraging trend line. On a y/y percentage change comparison, the all commodities PPI is up three months in a row with an each sequential month higher than the previous.

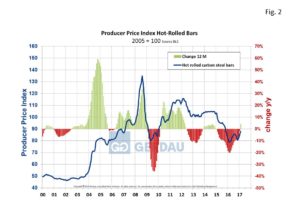

Figure 2 shows the PPI for hot-rolled carbon steel bars, along with the y/y percentage change. The PPI for hot-rolled carbon steel bars exhibits a similar pattern as the PPI for all commodities. It fell throughout 2012, plateaued in 2013, rebounded slightly in 2014 before plateauing once again. In 2015 the PPI for hot-rolled carbon steel bars fell sharply bottoming-out in February of 2015. It is now moving-up once again but remains at a level not logged since December 2009. On a positive note, in percentage y/y terms, the index has moved-up for the first time in 25 months.

Figure 2 shows the PPI for hot-rolled carbon steel bars, along with the y/y percentage change. The PPI for hot-rolled carbon steel bars exhibits a similar pattern as the PPI for all commodities. It fell throughout 2012, plateaued in 2013, rebounded slightly in 2014 before plateauing once again. In 2015 the PPI for hot-rolled carbon steel bars fell sharply bottoming-out in February of 2015. It is now moving-up once again but remains at a level not logged since December 2009. On a positive note, in percentage y/y terms, the index has moved-up for the first time in 25 months.

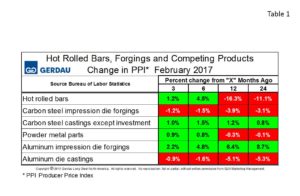

Table 1 presents hot rolled carbon steel bars and its competing materials. The data lists the PPI in percentage change terms referencing timeframes 3, 6, 12 and 24 months ago. This tells us whether or not pricing is moving up or down and gives a relative comparison to competing materials. Recent price changes of competing materials have been relatively small. However on a 12 month comparison, carbon steel castings have increased by 1.2% while carbon steel impression die forgings have declined by 3.9%. Over the same timeframe aluminum die casting declined by 5.1% and aluminum impression die forgings jumped by 6.4%. Steel die forgings and aluminum die casting have a cost advantage over its competing materials. This should shift material selection choices to the lower cost material, all other considerations being equal

Table 1 presents hot rolled carbon steel bars and its competing materials. The data lists the PPI in percentage change terms referencing timeframes 3, 6, 12 and 24 months ago. This tells us whether or not pricing is moving up or down and gives a relative comparison to competing materials. Recent price changes of competing materials have been relatively small. However on a 12 month comparison, carbon steel castings have increased by 1.2% while carbon steel impression die forgings have declined by 3.9%. Over the same timeframe aluminum die casting declined by 5.1% and aluminum impression die forgings jumped by 6.4%. Steel die forgings and aluminum die casting have a cost advantage over its competing materials. This should shift material selection choices to the lower cost material, all other considerations being equal

At Gerdau, we monitor the PPI which is issued monthly from the Bureau of Labor Statistics because our past analysis has led us to believe that the BLS PPI numbers measure-up to real-world pricing. We feel it is important for us and our customers to know where we are pricing-wise relative to history and how we stack-up against competing materials.