Portland Cement Shipments

Cement consumption ticked up in June after a down month in May. For the three months total (3MMT), ending June, national Portland cement shipments rose by 0.8% on a 3MMT year on year (y/y), basis. Four of the nine census regions posted higher 3MMT cement shipments y/y. Portland cement shipment data comes from the United States Geological Survey (USGS). Shipment data is two months in arrears.

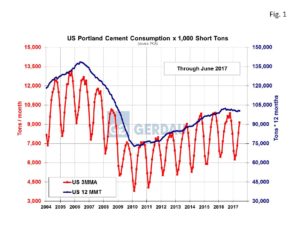

Figure 1 shows the three month moving average shipments in tons per month on the left-hand Y axis and the 12 month moving total on the right-hand Y axis. Growth over the last several months has begun to taper-off. Year to date through June, cement shipments totaled 47.20 million short tons (Mt), down 0.8% y/y.

Figure 1 shows the three month moving average shipments in tons per month on the left-hand Y axis and the 12 month moving total on the right-hand Y axis. Growth over the last several months has begun to taper-off. Year to date through June, cement shipments totaled 47.20 million short tons (Mt), down 0.8% y/y.

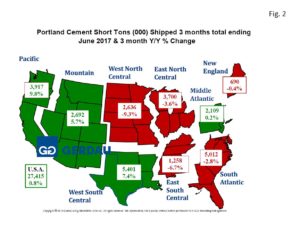

Figure 2  presents a map of the US by census region. The tonnage values are in 3MMT and the percentage change is 3MMT y/y. Green denotes growth, red means decline. The country as a whole recorded an increase of 0.8%, 3MMT y/y with shipments of 27.42 Mt for the 3 months ending June 2017 compared to 27.19 Mt for the same period last year.

presents a map of the US by census region. The tonnage values are in 3MMT and the percentage change is 3MMT y/y. Green denotes growth, red means decline. The country as a whole recorded an increase of 0.8%, 3MMT y/y with shipments of 27.42 Mt for the 3 months ending June 2017 compared to 27.19 Mt for the same period last year.

The largest consuming region was the West South Central with 5.40 Mt, 3MMT as growth in the West South Central rose 7.4%, 3MMT y/y. The region with the second largest 3MMT consumption, (5.01 Mt) was the South Atlantic which recorded -2.8%, 3MMT y/y. The third highest consuming regions was the Pacific with 3.92 Mt. The Pacific regions growth jumped 9.8%, 3MMT y/y. The East North Central consumed 3.70 Mt, 3MMT, off 3.6% y/y. The Mountain zone region posted growth for the three months ending June, up 5.7% consuming 2.69 Mt of cement.

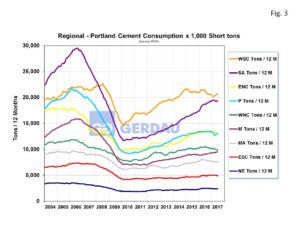

Figure 3 illustrates the census regions historic growth from 2004 to present. The two volume leading regions include the West South Central (20% of total US shipments over the 3 months), and the South Atlantic (18% of US total shipments over the past 3 months). The South Atlantic region has been trending steadily higher but has plateaued over the last couple of months. The West South Central after falling through most of 2016, has reversed course and has trended higher thus far in 2017. The third largest consuming region over the past three months was the Pacific region with 14% of total cement shipments. The East North Central region ranked the next largest with 13%, followed by the Mountain zone at 10%.

illustrates the census regions historic growth from 2004 to present. The two volume leading regions include the West South Central (20% of total US shipments over the 3 months), and the South Atlantic (18% of US total shipments over the past 3 months). The South Atlantic region has been trending steadily higher but has plateaued over the last couple of months. The West South Central after falling through most of 2016, has reversed course and has trended higher thus far in 2017. The third largest consuming region over the past three months was the Pacific region with 14% of total cement shipments. The East North Central region ranked the next largest with 13%, followed by the Mountain zone at 10%.

Cement capacity utilization in the U.S. is reportedly tightening and rebuilding and repair work from hurricanes Harvey and Irma will place additional demands on supply. No shortage is expected since imported cement is readily available should domestic capacity be insufficient.

At Gerdau we routinely monitor Portland cement shipments because of its strong relationship to the consumption of rebar and because cement shipments give an excellent on how the overall construction (infrastructure, residential and non-residential buildings), market is performing.