Oil and Gas Rotary Rig Counts

The total number of operating rigs in the US the week ending September 5th was 943, 759 oil and 183 gas. In percentage terms, week on week, oil rigs declined by 0.5%, while gas rigs were down 1.1%. On a month on month basis, oil rigs were off 0.9% and gas rigs were declined by 6.3%. In numerical terms, the total decline over the month was 18 rigs. Looked at on a year on year (y/y) comparison, rigs are up substantially, +87% for oil and +122% for gas. The combined figure was +92%.

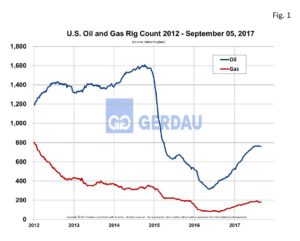

Figure 1 shows the Baker Hughes US Rotary Rig Counts for oil and gas equipment in the US from 2012 to present. Despite the recent upward momentum, the rig count is still sharply lower than recent historic highs that exceeded 2,000.

Figure 1 shows the Baker Hughes US Rotary Rig Counts for oil and gas equipment in the US from 2012 to present. Despite the recent upward momentum, the rig count is still sharply lower than recent historic highs that exceeded 2,000.

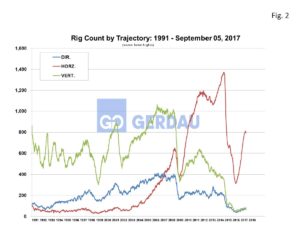

Figure 2 examines well type by trajectory. Horizontal drilling is by far the most common, accounting for 84.2% of the total. Directional wells make-up 8.6% and vertical wells account for 7.2%. Ten years ago the ratio of well type was quite different. Vertical wells dominated with 55.4% share, followed by horizontal with 24.0% and directional with 20.6%.

examines well type by trajectory. Horizontal drilling is by far the most common, accounting for 84.2% of the total. Directional wells make-up 8.6% and vertical wells account for 7.2%. Ten years ago the ratio of well type was quite different. Vertical wells dominated with 55.4% share, followed by horizontal with 24.0% and directional with 20.6%.

Texas remains the state with the greatest number of wells with 454, (48%), followed by Oklahoma with 130, (13.7%), New Mexico with 65, (6.9%), Louisiana and North Dakota each count 52, (5.5%). These five state together account for 79.4% of the nation’s rig count.

Prices have moved higher over the past month. Referencing Bloomberg Energy, West Texas Intermediate (WTI) crude oil closed at $48.56 per barrel today (9/05/2017), up $2.60 per barrel since August 30th. Its 52 week range was $42.52 to $58.34 per barrel. WTI crude has been trending higher since its recent low of $44.83 on June 21st. Brent crude oil closed at $53.12 per barrel today, its highest point over the past four weeks. Its 52 week range was $42.53 to $58.34 per barrel. Brent crude has been trending higher since its recent low of $44.83 on June 21st. Natural gas closed at $2.98 per MMBtu today, it has been trading in a narrow range over the past month at between $2.81 and $3.07 per MMBtu. Its 52 week range was $2.80 to $3.62 per MMBtu. Hurricane Harvey caused an estimated 27% of the nations’ refining capacity to come off-line. Flooding has made it hard for truck deliveries to get through, as well as made it more difficult to bring in staff.

Canadian rotary rig count totaled 201 on September 1st, 102 oil rigs and 99 natural gas rigs. These figures were down 17.7% and up 6.5% m/m respectfully. On a y/y comparison, oil rigs were up 32.5%, while gas rigs increased by 65% for a combined increase of 46.7%.

At Gerdau we monitor rig counts along with the price of oil and natural gas since it has a major impact on long product sales to include Special Bar Quality sucker rods for downhole pumping strings to merchant and structural products for rigs and oilfield equipment.