Oil and Gas Rotary Rig Counts

The total number of operating rigs in the U.S. the week as of July 13th was 1,054 with 863 oil rigs and 189 gas. In percentage terms, on a month on month, (m/m) basis, oil rigs were relatively flat, (+2 rigs) as gas rigs decreased by 2.3% (-5 rigs). On a year on year, (y/y) comparison, total rigs were up +10.7%, oil rigs were +12.8% and +1.1% for gas. This is good news for sucker rod and oil country tubular products producers.

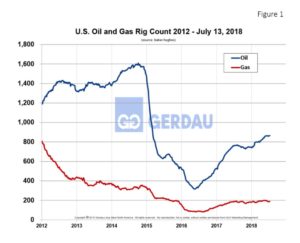

Figure 1 shows the Baker Hughes U.S. Rotary Rig Counts for oil and gas equipment in the U.S. from 2012 to present. Oil rigs rose steadily from 316 in late May 2016 topping-out at 863 this week. Gas rigs bottomed-out at 81 in August 2016 and currently sits at 189 rigs.

Figure 1 shows the Baker Hughes U.S. Rotary Rig Counts for oil and gas equipment in the U.S. from 2012 to present. Oil rigs rose steadily from 316 in late May 2016 topping-out at 863 this week. Gas rigs bottomed-out at 81 in August 2016 and currently sits at 189 rigs.

For the week ending July 13th, Texas was operating 526 rigs, plus two off-shore rig, (50% of the total), followed by Oklahoma with 141, (13.4%), New Mexico with 99, (9.4%). Louisiana had 41 on-land and 17 off-shore, (5.5%). North Dakota’s count was 57, (5.4%). These five states together account for 83.6% of the nation’s rig count.

Prices are moving up. Referencing Bloomberg Energy, West Texas Intermediate (WTI) crude oil in intraday trading was at $69.35 today. Its range over the past 52 weeks has been between $47.39 and $75.27 per barrel. Brent crude oil in intraday trading was at $72.58 per barrel today. Its 52 week range was $50.82 to $80.07 per barrel. Natural gas in intraday trading today was at $2.77 per MMBtu today. Its 52 week range was between $2.61 and $3.04 per MMBtu.

Thanks to the shale boom, new U.S. supply will cover more than half the world’s oil demand growth to 2023, the agency said. Production from the prolific Permian Basin will double over the period and the country’s total liquid hydrocarbon output will rise to 17 million barrels a day from 13.2 million last year. The American surge and a slightly weaker outlook for global demand growth make uncomfortable reading for OPEC. The IEA slashed projections for the amount of crude needed from the cartel, indicating its supply cuts would need to stay in place until 2021 to avoid creating another prolonged surplus.

At Gerdau we monitor rig counts along with the price of oil and natural gas since it has a major impact on long product sales to include Special Bar Quality sucker rods for downhole pumping strings to merchant and structural products for rigs and oilfield equipment.