Non Residential Construction Forecast

Twice per year the American Institute of Architects (AIA) gathers construction forecasts from seven well-known forecasting entities. These firms individually predict growth for the 2017 and 2018 non-residential construction market. From this input the AIA then produces a consensus forecast. The firms participating in this activity include: Dodge Data and Analytics, IHS Economics, Moody’s Economy.com, Associated Builders and Contractors, FMI, ConstructConnect and Wells Fargo Securities, LLC.

Twice per year the American Institute of Architects (AIA) gathers construction forecasts from seven well-known forecasting entities. These firms individually predict growth for the 2017 and 2018 non-residential construction market. From this input the AIA then produces a consensus forecast. The firms participating in this activity include: Dodge Data and Analytics, IHS Economics, Moody’s Economy.com, Associated Builders and Contractors, FMI, ConstructConnect and Wells Fargo Securities, LLC.

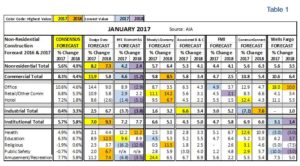

Table 1 presents the year on year percentage change for each of the seven firms along with the AIA consensus forecast. The consensus forecast predicts that Non Residential Construction (NRC) will grow 5.6% in 2017, followed by 4.9% growth in 2018. The colored cells depict the highest and lowest forecast for each year. For 2017 the yellow cells are the highest value and the blue cells the lowest. In 2018 the orange cells are the lowest and the purple cells the highest. Dodge and Moody’s are the most optimistic with 8 and 6 of the highest estimates for 2017 & 2018. IHS Economics is the most pessimistic by far with 13 of the lowest estimates for 2017 & 2018. Wells Fargo is the 2nd most pessimistic with 7 of the lowest estimates for 2017 & 2018, (all of these within institutional buildings). It had the highest estimates for office construction for both years. The two firms with estimates closest to the mean were Associated Builders and Contractors and FMI. The spread of estimates for summary categories in 2017: Total NRC, 4 point spread from 4.2% to 8.2%. Commercial, 7.3 point spread from 4.6% to 11.9%. Industrial, 13.8 point spread from (7.2%) to 6.6%. Institutional total, 3.9 point spread from 3.1% to 7.0%. The two most extreme spreads in 2017 were: Amusement, a 31.2 point spread from (6.8%) to 24.2% and Religious, a 19.3 spread from (16.2%) to 3.2%. The range of spreads are even greater for 2018. This is the norm, the further you look out the cloudier the forecast.

We track and present the AIA consensus forecast to help you, our customers, plan for your businesses. As you can see, forecasting is challenging and as such needs to be taken with a “grain of salt”. It does appear at this point however that 2017 and 2018 should produce another year of healthy NRC growth. The economy continues to grow, with solid job creation and rising wages. This coupled with low interest rates, strong consumer confidence and readily available construction loans should keep the ball rolling.