Non-Residential Consensus Forecast for 2017 and 2018

In its July update, the American Institute of Architects (AIA) consensus non-residential forecast is for aggregate spending to increase by 3.8% year on year (y/y), in 2017. Non-residential spending is projected to increase an additional 3.6% in 2018.

Twice per year, the American Institute of Architects (AIA), publishes its non-Residential Consensus Forecast. The consensus forecast is the average of seven firms’ individual forecasts. The firms include: Dodge Data & Analytics, IHS-Global, Moody’s Ecomomy.com, FMI, ConstructConnect, Associated Builders and Contractors and Wells Fargo Securities, LLC.

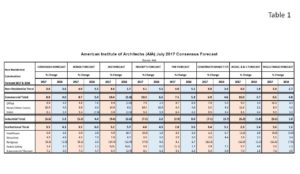

Table 1 lists the consensus forecast and the individual company forecasts. The consensus commercial forecast for 2017 is expected to advance 8.8% year on year, followed by +4.0% y/y for 2018. The commercial forecast is based on input from office, retail and other commercial and hotel construction. The consensus forecast for the industrial segment of non-residential construction is forecast to fall 6.6% in 2017, but is projected to rebound by 1.1% in 2018. The institutional component of the overall consensus forecast is a product of: healthcare, education, religious, public safety and amusement/recreation buildings. Institutional spending is estimated to increase by 3.5% y/y in 2017 and a further 4.1% in 2018.

Table 1 lists the consensus forecast and the individual company forecasts. The consensus commercial forecast for 2017 is expected to advance 8.8% year on year, followed by +4.0% y/y for 2018. The commercial forecast is based on input from office, retail and other commercial and hotel construction. The consensus forecast for the industrial segment of non-residential construction is forecast to fall 6.6% in 2017, but is projected to rebound by 1.1% in 2018. The institutional component of the overall consensus forecast is a product of: healthcare, education, religious, public safety and amusement/recreation buildings. Institutional spending is estimated to increase by 3.5% y/y in 2017 and a further 4.1% in 2018.

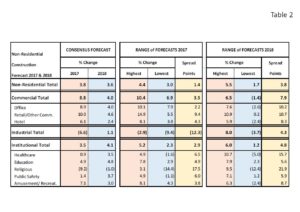

There is reasonably good agreement between the seven firms on the overall percentage point rise in 2017 for non-residential construction. The consensus forecast is +3.8% and the range of forecasts was +3.0% to +4.4%, for a 1.4 point spread. For 2018, the spread rises to 3.8 points, ranging from +1.7% to +5.5%. The tighter range for 2017 makes sense since five months of construction is in the books. Near term forecasting is always easier to predict with accuracy than longer term forecasting.

Table 2 reproduces the AIA consensus forecast with the addition of the range of forecasts and spread for each of 2017 and 2018. The sub-index with the best agreement between the contributing firms in 2017 was office construction with a spread of just 2.2 points. This strong level of agreement did not follow-through into 2018 however as the range ballooned to 10.2 points, from -2.6% to +7.6%. The sub-index with the greatest amount of spread in 2017 and 2018 was religious structures. Spreads of 17.5 points in 2017 and 21.9 points in 2018 were calculated for this project category.

reproduces the AIA consensus forecast with the addition of the range of forecasts and spread for each of 2017 and 2018. The sub-index with the best agreement between the contributing firms in 2017 was office construction with a spread of just 2.2 points. This strong level of agreement did not follow-through into 2018 however as the range ballooned to 10.2 points, from -2.6% to +7.6%. The sub-index with the greatest amount of spread in 2017 and 2018 was religious structures. Spreads of 17.5 points in 2017 and 21.9 points in 2018 were calculated for this project category.

Construction expenditures for commercial/industrial construction have increased by 7% year to date (YTD), down from the 10% growth recorded in 2016. A slowdown in activity was expected for 2017 but this was anticipated to be offset by a bump in institutional investment. The predicted increase in the institutional sector fell well short of expectations. Year to date institutional speeding is tracking at just +3%, well short of the 5.8% forecasted in the AIA January consensus forecast. As a result the AIA forecasting panel reduced its forecast for the remainder of 2017 and through 2018.

Despite the lower forecast, the good news is that growth in non-residential construction is expected to continue. This is exciting news for an economic expansion that is well into its eighth year of expansion.

At Gerdau we monitor and review the AIA consensus forecast each January and July looking for clues on the future of non-residential construction activity. History has shown that the AIA consensus forecast is a valuable tool for business planning purposes.