Job Turnover and Openings Report

Job openings were little changed at 5.88 million on the last business day of November and remain near record highs according to the Bureau of Labor Statistics. Over the month, hires were also little changed at 5.49 million, while separations remained at 5.20 million. This translates to a hiring rate of 3.7% and a separation rate of 3.5%. This is indisputable evidence that the job market is strong indeed.

The job openings and labor turnover survey serves as a demand-side indicator of labor shortages at the national level. Data on job openings, hires, quits, layoffs and discharges, and other separations are based on a sample of approximately 16,400 establishments and cover all nonfarm establishments in the private sector as well as federal, state, and local governments in the 50 states and the District of Columbia. Levels and rates are calculated for each category. The rate is the level as a percent of total employment. For job openings, the rate is computed as the number of openings as a percent of employment plus openings. The data are useful in determining what is behind the net numbers released in the monthly report.

Over the 12 months ending in November, hires totaled 64.6M and separations totaled 62.4M yielding a net employment gain of 2.1M. These totals include workers who may have been hired and separated more than once during the year.

Businesses have plenty of job openings to fill. The number of openings has been steadily falling from 6.14M in July to 6.09 in August, 6.18M in September, 5.93M in October and 5.88M in November.

In Construction, the current number of openings is 210,000, down from 237,000 in July but up from a low of 179,000 in September. Manufacturing job openings totaled 378,000 in November down from a recent high of 435,000 in both August and September. The “Durable Goods” category had 231,000 openings at the end of November, while “non-Durable Goods” had 147,000 openings.

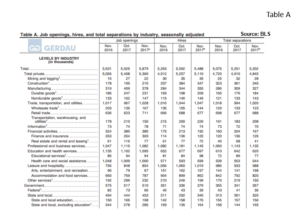

Fields with the largest job openings include: Education and Health services with 1.10M, Professional and business services with 1.08M, Trade, warehousing and utilities with1.03M, and Retail trade with 0.71M. Table A  breaks down the complete seasonally adjusted job openings, hires and total separations by industry.

breaks down the complete seasonally adjusted job openings, hires and total separations by industry.

The labor market fundamentals remain remarkably healthy well into the eighth year of steady expansion. The strength of the labor market is also apparent in the quit rate of 2.2%, which matches its cyclical high. Thus, workers perceive that jobs are plentiful and are more at ease to switch jobs. However, up until this point, there is still sufficient slack to keep wage pressures at bay. The low inflation level is helping the situation. Wage pressure is expected to build in 2018.

At Gerdau, we keep a keen eye on the employment numbers because we have demonstrated that there is an excellent correlation between employment levels and steel consumption. High job creation and low unemployment translate to strong steel demand and vice versa.