Global Crude Steel Production and Capacity Utilization

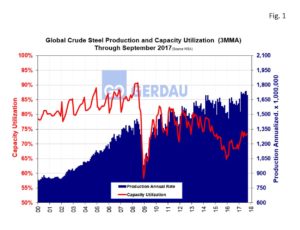

Worldsteel Association (WSA) reports that global crude steel production totaled 141.43 million tonnes (Mt) at a capacity utilization rate, (CUR) of 73.5% in September. On a year on year, (y/y) comparison, global crude steel production in September increased by 4.91 Mt as the capacity utilization rate rose 5.0 percentage points.

On a three month moving average, (3MMA) basis the rate of annualized production rate through September was 1,723.6 Mt. WSA estimates that current global capacity stands at 2,345 Mt, thus, the annual excess global capacity at current operating rates is approximately 621.4 Mt. For the nine months ending September total worldwide raw steel production totaled 1,267.67 Mt, up 69.60 Mt year to date y/y or 5.8%.

Figure 1 charts global steel production on the right-hand Y axis and percent CUR on the left-hand Y axis. Both capacity utilization and crude steel production are trending sharply higher year to date, (YTD) 2017.

Figure 1 charts global steel production on the right-hand Y axis and percent CUR on the left-hand Y axis. Both capacity utilization and crude steel production are trending sharply higher year to date, (YTD) 2017.

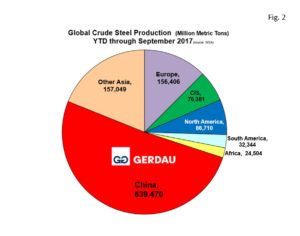

Figure 2 shows a pie chart of raw steel production by region YTD, through September 2017. China with 639,470 Mt YTD, +6.0% y/y accounts more than half, (50.5%) of global raw steel production. China’s ratio of global steel production. The next biggest slice was “other Asia” with 236,809 Mt or 18.7% of the global total. Countries in “other Asia” include: India, Japan, South Korea, Pakistan, Taiwan, Thailand and Vietnam. Adding China + other Asia, accounts for well over two thirds, (69.2%) of global steel output.

shows a pie chart of raw steel production by region YTD, through September 2017. China with 639,470 Mt YTD, +6.0% y/y accounts more than half, (50.5%) of global raw steel production. China’s ratio of global steel production. The next biggest slice was “other Asia” with 236,809 Mt or 18.7% of the global total. Countries in “other Asia” include: India, Japan, South Korea, Pakistan, Taiwan, Thailand and Vietnam. Adding China + other Asia, accounts for well over two thirds, (69.2%) of global steel output.

Europe was the next largest producing region YTD with 156,406 Mt, accounting for 12.3% of the global total. The CIS countries (Byelorussia, Kazakhstan, Moldova, Russia, Ukraine and Uzbekistan) combined tonnage was 76,318 Mt YTD for 6.0% of the total. South America accounted for 32,344 Mt, 2.6% of the global total. Africa accounted for 20,650 Mt, 1.9% of the global total.

North America (which includes Canada, US and Mexico as well as Cuba, El Salvador, Guatemala, Trinidad & Tobago), produced a combined 86,710 Mt, accounting for 6.8% of global output. North Americas’ share of global output moved-up 1.4 percentage points y/y.

The World Steel Association, Short-Range Outlook, (SRO) for apparent steel consumption in 2017 and 2018 was released on October 14th. Its global raw steel production forecast for 2017 was revised sharply upward from its April SRO of 1,535.2 Mt, to 1,622.1 Mt, an 86.8 Mt increase. For 2018, the WSA SRO calls for raw steel production to increase to 1,648.1 Mt, a 1.6% y/y increase. In its commentary WSA stated that it sees the world in its - “best balance of risks since the 2008 economic crisis.” Forward concerns mentioned were - “escalating geopolitical tension in the Korean peninsula, China’s debt problem and rising protectionism in many locations.”

At Gerdau we keep a keen eye on Global crude steel production and capacity utilization because of its huge impact on global trade and its influence on domestic pricing.