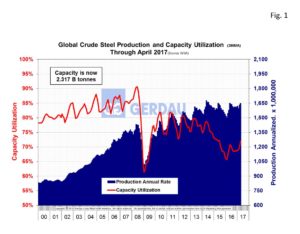

Global Crude Steel Production and Capacity Utilization

Worldsteel Association (WSA) reports that global crude steel production totaled 142.08 million tonnes (Mt) at a capacity utilization rate (CUR) of 73.6% in April. This was a 3.1 point increase from last Mays’ 70.5% capacity utilization and the highest since September 2015. At the three month moving average (3MMA), rate of current output, annual production would be 1,650 Mt. WSA estimates that current global capacity stands at 2,317 Mt. This means that there is 667 Mt of excess capacity in the world at current operating rates. This is roughly five times what the entire NAFTA region is expected to consume in 2017.

Figure 1 charts global steel production on the right-hand Y axis and percent capacity utilization on the left-hand Y axis. At 1,650 Mt, production is approaching the all-time high of 1,677 reached in May 2014. Capacity utilization is trending up thus far in 2016 but is still far below the 80 to 90% level enjoyed in the 2000 to 2008 timeframe.

Figure 1 charts global steel production on the right-hand Y axis and percent capacity utilization on the left-hand Y axis. At 1,650 Mt, production is approaching the all-time high of 1,677 reached in May 2014. Capacity utilization is trending up thus far in 2016 but is still far below the 80 to 90% level enjoyed in the 2000 to 2008 timeframe.

The US produced 6.7 Mt of crude steel in April 2017, an increase of 1.8% compared to April 2016. China’s crude steel production for April 2017 was 72.8 Mt, an increase of 4.9% y/y. Japan produced 8.8 Mt of crude steel in April 2017, an increase of 3.0% y/y. South Korea’s production for April 2017 was 5.5 Mt, a decrease of 2.9% y/y. In the EU, Germany produced 3.9 Mt of in April 2017, an increase of 8.1% y/y. Turkey’s crude steel production for April 2017 was 3.0 Mt, up 6.5% y/y. Brazil’s production for April 2017 was 2.9 Mt, up by 25.9% y/y.

In its latest publication WSA shows a series of pie charts on crude steel production and apparent finished steel consumption. It examines how much things have changed over the 10 year period between 2006 and 2016. In 2006 China produced 33.6% of the world steel and consumed 33.0%, a reasonable match. By 2016, China’s production was 49.6% of the world steel and just 45% of the consumption, badly out of balance leading to massive exports. NAFTA in 2006 produced 10.4% of the world’s steel and consumed 13.5%, thus a significant importer. By 2016 NAFTA’s share of global steel production fell to 6.7%, while its consumption ratio fell to 8.7%.

The Worldsteel Association’s short range outlook projects that 2017 crude steel production will increase by 0.5% to 1,509.6 Mt y/y. It predicts a 2.9% increase for the NAFTA region to 137.4 Mt of which should put US volume at approximately 80.8 Mt.

At Gerdau we keep a keen eye on Global crude steel production and capacity utilization because of its huge impact on global trade and its influence on domestic pricing.