Employment: Continuous and New Jobless Claims

The U.S. labor market continues to perform well. Continuous claims as well as new claims for unemployment insurance benefits remain at historic lows. Seasonally adjusted (SA), continuous claims stood at 1.96 million, (M) on November 18th, climbing 42,000 week on week. The SA four week moving average (4WMA), was a shade higher at 1.91M, up 19,000 week on week and down 109,000 year on year, (y/y).

New SA claims for unemployment insurance were 238,000 for the week ending November 25th, -2,000 w/w. The 4WWA totaled 242,000, also down 2,000 w/w, and lower by 10,000 y/y.

Unemployment insurance claims are a count of recipients by state of benefits mandated by federal law. Initial claims for unemployment benefits provide a proxy for layoffs, whereas continuing claims give a timely sense of the stock of unemployed workers.

Figure 1 charts SA continuous claims for unemployment from 2013 to present. This was the lowest level since 1973 when the workforce was much smaller. This was the second increase, in as many weeks for a total of 89,000. Despite the increase, there is little to be concerned about, as continuous claims for unemployment remain very low and are currently lower than they were at the beginning of this year.

Figure 1 charts SA continuous claims for unemployment from 2013 to present. This was the lowest level since 1973 when the workforce was much smaller. This was the second increase, in as many weeks for a total of 89,000. Despite the increase, there is little to be concerned about, as continuous claims for unemployment remain very low and are currently lower than they were at the beginning of this year.

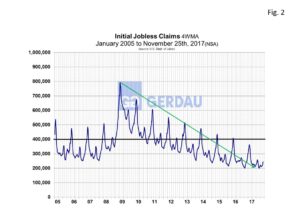

Figure 2  charts NSA initial claims for unemployment insurance from 2005 to present. Despite rising for three weeks in a row the average remains at historic lows. The low level of initial claims is indicative of a labor market that is in very good health.

charts NSA initial claims for unemployment insurance from 2005 to present. Despite rising for three weeks in a row the average remains at historic lows. The low level of initial claims is indicative of a labor market that is in very good health.

The insured unemployment rate was unchanged at 1.4% in the week ended November 18. Twelve states reported an increase in NSA new filings in excess of 1,000 in the week ended November 18th. California was the highest with 6,100 layoffs in the agriculture, forestry, fishing, and hunting industry. Missouri, Illinois, Pennsylvania, Michigan, Washington, Georgia, Iowa, Texas, Connecticut, Ohio and Arizona followed. No states reported a decline in NSA new filings in excess of 1,000 in the week ended November 18.

The U.S. labor market is arguably at full employment. The low level of initial claims for unemployment insurance benefits is one of many signs of a healthy labor market. In spite of the recent natural disasters causing a spike in the number of filings, new filings have remained south of the psychological 300,000 mark.

At Gerdau, we keep a keen eye on the employment numbers because we have demonstrated that there is an excellent correlation between employment levels and steel consumption. High job creation and low unemployment translate to strong steel demand and vice versa.