Employment: Continuous and New Jobless Claims

The U.S. labor market continues to perform well. Continuous claims as well as new claims for unemployment insurance benefits are at historic lows. Seasonally adjusted (SA), claims stood at 1,896,000 on October 7th, down 8,000 week on week. The non- seasonally adjusted, (NSA) four week moving average (4WMA), was a shade higher at 1,908,000, down 20,750 week on week and down 201,250 year in year.

Unemployment insurance claims are a count of recipients by state of benefits mandated by federal law. Initial claims for unemployment benefits provide a proxy for layoffs, whereas continuing claims give a timely sense of the stock of unemployed workers.

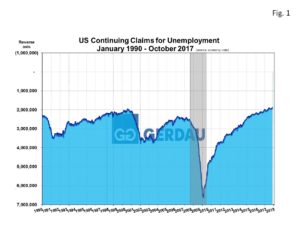

Figure 1 charts SA continuous claims for unemployment claims from 1990 to present. The Y axis is on a reverse scale. To find a lower number, one would have to go all the way back to 1973 when the workforce was much smaller.

charts SA continuous claims for unemployment claims from 1990 to present. The Y axis is on a reverse scale. To find a lower number, one would have to go all the way back to 1973 when the workforce was much smaller.

The 4WMA for initial unemployment benefits remains low and is indicative of a labor market that is in good health. Initial claims for unemployment insurance benefits fell 5,000 from the previous week to a revised level of 229,000 for the week ended October 28th. The 4WMA fell 7,250 from the previous week’s revised average to 232,500, also the lowest level since 1973. The insured unemployment rate slipped from 1.4% to 1.3% in the week ended October 21st.

Two states and Puerto Rico reported an increase in NSA new filings > 1,000 in the week ended October 21st. Puerto Rico posted the greatest number followed by New York and Pennsylvania. Florida reported a decline in NSA new filings > 1,000 in the week ended October 21. Florida noted fewer layoffs in construction, manufacturing, wholesale trade, retail trade and services.

The economy continues to generate solid employment numbers despite the ongoing debate that the labor market is at “full” employment. According to the Bureau of Labor Statistics, non-farm payroll jumped by 261,000 in October. This in sharp contrast to the meager 110,000 increase in September, which was impacted by the aftermath of the recent hurricanes. Goods producers reported strong results, adding 85,000 jobs. Construction also posted solid numbers, adding 62,000 jobs m/m, influenced by the rebuilding efforts in Texas and Florida. The service sector added 150,000 positions on the heels a tough-going in September.

At Gerdau, we keep a keen eye on the employment numbers because we have demonstrated that there is an excellent correlation between employment levels and steel consumption. High job creation and low unemployment translate to strong steel demand and vice versa.