Employment: Continuous and New Jobless Claims

The U.S. labor market continues to perform well. Continuous claims for unemployment insurance benefits remain close to historic lows. Seasonally adjusted (SA), claims stood at 1,949,000 on July 1st, down 16,000 week on week. The SA four week moving average (4WMA), was a shade higher at 1,950,250, down 182,250 year on year. The 4WMA was down 314,750 from two years ago and was down 1.367 million from July 2012.

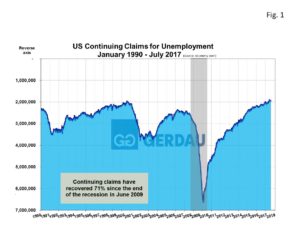

Figure 1 charts SA continuous claims for unemployment claims from 1990 to present. The Y axis is on a reverse scale. The current level of claims is at the lowest point since May 13, 2000.

Figure 1 charts SA continuous claims for unemployment claims from 1990 to present. The Y axis is on a reverse scale. The current level of claims is at the lowest point since May 13, 2000.

New SA filings for unemployment insurance rose fell by 10,000 to 244,000 for the week ending July 27th, the same number as its four week moving average. The four-week moving average remains low and is indicative of a labor market that is in good health.

Unemployment insurance claims are a count of recipients by state of benefits mandated by federal law. Initial claims for unemployment benefits provide a proxy for layoffs, whereas continuing claims give a timely sense of the stock of unemployed workers.

Five states reported an increase in not seasonally adjusted (NSA), new filings greater than 1,000 in the week ended July 15th. California was the highest with 6,900, mostly originating in the service industry. The other states included: Alabama (2,700), Georgia (2,500), South Carolina (2,100) and Texas (1,100). Ten states and Puerto Rico reported a decline in NSA new filings in greater than 1,000 for the week ended July 15th. The largest decreases were in: New York (-8,300), Michigan (-6,900), Kentucky (-6,900), New Jersey (-3,900) and Ohio (-3,100

The economy continues to generate solid employment numbers despite the ongoing debate that the labor market is at “full” employment. July’s employment report will be especially important for this reason.

At Gerdau, we keep a keen eye on the employment numbers because we have demonstrated that there is an excellent correlation between employment levels and steel consumption. High job creation and low unemployment translate to strong steel demand and vice versa.