Dodge Momentum Index

The Dodge Momentum Index increased 0.5% to 142.6 in February from the revised January score. On a year on year, (y/y) comparison, the composite index was up 2.0%. The commercial sub-index posted a moderate decrease for the month, while the institutional index recorded a substantial increase for the month.

The Dodge Momentum Index is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

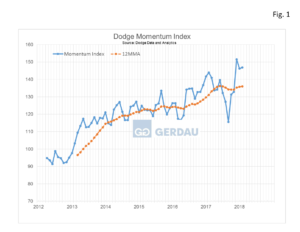

Figure 1 presents the Dodge momentum index and its twelve month moving average, (12MMA) from 2012 to present. The index had fallen for three months through September. The volatile index bounced back in October and has trended higher since then. The 12 month moving average (12MMA) dipped for a few months beginning in July, then plateaued for the three months ending November. In a very encouraging sign, the 12MMA has since moved higher in each of the past three months. On a 12MMA y/y basis, the composite index was up 3.7%.

Figure 1 presents the Dodge momentum index and its twelve month moving average, (12MMA) from 2012 to present. The index had fallen for three months through September. The volatile index bounced back in October and has trended higher since then. The 12 month moving average (12MMA) dipped for a few months beginning in July, then plateaued for the three months ending November. In a very encouraging sign, the 12MMA has since moved higher in each of the past three months. On a 12MMA y/y basis, the composite index was up 3.7%.

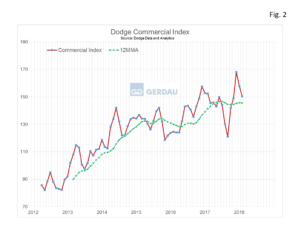

Figure 2 breaks out the commercial sub-index and its 12MMA. The commercial index declined 7.5 points or -4.7% in February on the heels of a 10.2 point drop in January. Per Dodge, this is a sign that commercial building construction growth could ease in 2018 in response to rising vacancy rates for offices and warehouses. The 12MMA commercial line declined during the three month period from September to November. It has been flat over the last three months. However, on a 12MMA y/y basis, the commercial sub-index was up 2.9%.

breaks out the commercial sub-index and its 12MMA. The commercial index declined 7.5 points or -4.7% in February on the heels of a 10.2 point drop in January. Per Dodge, this is a sign that commercial building construction growth could ease in 2018 in response to rising vacancy rates for offices and warehouses. The 12MMA commercial line declined during the three month period from September to November. It has been flat over the last three months. However, on a 12MMA y/y basis, the commercial sub-index was up 2.9%.

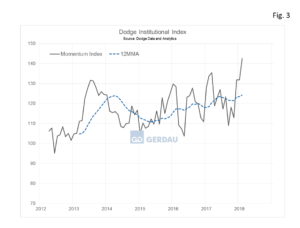

Figure 3 shows the institutional sub-index and its 12MMA. The institutional sub-index surged 10.8 points or 8.2% m/m. Per Dodge, the institutional building construction continues to feed off the massive number of state and local bonds issued for schools and other institutional buildings over the past few election cycles. The 12MMA line has been trending higher for three consecutive months. On a 12MMA y/y basis the institutional sub-index increased by 4.9%.

Figure 3 shows the institutional sub-index and its 12MMA. The institutional sub-index surged 10.8 points or 8.2% m/m. Per Dodge, the institutional building construction continues to feed off the massive number of state and local bonds issued for schools and other institutional buildings over the past few election cycles. The 12MMA line has been trending higher for three consecutive months. On a 12MMA y/y basis the institutional sub-index increased by 4.9%.

In February, 16 projects each with a value of $100 million or more entered planning. For the institutional sector, the leading projects were the $450 million MSG Sphere Arena in Las Vegas, NV and the $412 million St. Jude’s Children’s Hospital Research Center in Memphis, TN. The leading commercial projects were the $280 million first phase of the Sentinel Data Center in Sterling, VA and a $150 million mixed-use project in San Jose, CA.

At Gerdau we regularly monitor the strong relationship established between the Dodge Momentum Index and actual non-residential construction spending one here hence. This is a valuable leading indicator for planning purposes for construction industry professionals including you our valued customers.