Dodge Momentum Index

The Dodge Momentum Index fell 5.1% to 136.7 in January after a significant upward revision to the December score. On a year on year, (y/y) comparison, the composite index was up 1.4%. The commercial sub-index posted a significant decrease for the month, while the institutional index declined slightly.

The Dodge Momentum Index is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

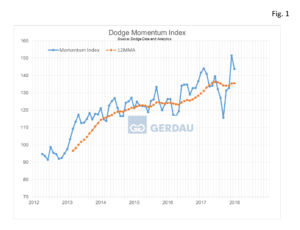

Figure 1 presents the Dodge momentum index and its twelve month moving average, (12MMA) from 2012 to present. The index had fallen for three months through September, creating a concern that a cyclical decline may have begun. The volatile index bounced back in October and has moved higher for three months in a row prior to January’s roll-back. The 12 month moving average (12MMA) dipped for a few months beginning in July, plateauing at 134 for the three months ending November. The index has since moved higher in both December and January.

Figure 1 presents the Dodge momentum index and its twelve month moving average, (12MMA) from 2012 to present. The index had fallen for three months through September, creating a concern that a cyclical decline may have begun. The volatile index bounced back in October and has moved higher for three months in a row prior to January’s roll-back. The 12 month moving average (12MMA) dipped for a few months beginning in July, plateauing at 134 for the three months ending November. The index has since moved higher in both December and January.

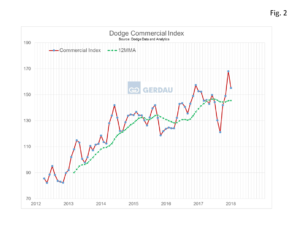

Figure 2  breaks out the commercial sub-index and its 12MMA. The commercial sub-index shows a near mirror-image of the overall momentum image. This is because a significant ratio, (about 75%) of non-residential projects originates from the private sector. The commercial index declined 13.0 points or -7.7% in January. Similar to the composite index, the 12MMA commercial line dished for a few months before resuming its upward trend. The commercial sub-index advanced 1.6% on a y/y basis.

breaks out the commercial sub-index and its 12MMA. The commercial sub-index shows a near mirror-image of the overall momentum image. This is because a significant ratio, (about 75%) of non-residential projects originates from the private sector. The commercial index declined 13.0 points or -7.7% in January. Similar to the composite index, the 12MMA commercial line dished for a few months before resuming its upward trend. The commercial sub-index advanced 1.6% on a y/y basis.

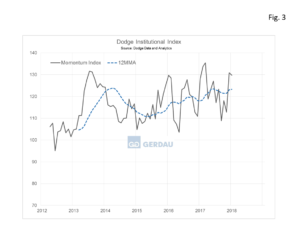

Figure 3 shows the institutional sub-index and its 12MMA. The institutional sub-index fell 1.2 points or -0.9% m/m. The institutional sub-index is even more volatile than the commercial sub-index. However the 12MMA line illustrates a similar look as the commercial, showing a decline which started last June and continued for six months before rebounding in December and January. On a y/y basis the institutional sub-index increased by 1.2%.

Figure 3 shows the institutional sub-index and its 12MMA. The institutional sub-index fell 1.2 points or -0.9% m/m. The institutional sub-index is even more volatile than the commercial sub-index. However the 12MMA line illustrates a similar look as the commercial, showing a decline which started last June and continued for six months before rebounding in December and January. On a y/y basis the institutional sub-index increased by 1.2%.

The fourth quarter of 2017 was particularly strong for the momentum Index, and January's fallback returns it to a more sustainable level. This points to continued growth for the commercial sector in 2018 despite being at a mature phase of its cycle. Planning in the institutional sector has yet to see the benefit of the numerous education-related bond measures passed in recent years.

In January, five projects each with a value of $100 million or more entered planning. For the commercial sector, the leading projects were a $200 million office building in Boston MA and a $152 million warehouse in Banning CA. The leading institutional projects were a $440 million water park in Branson MO and a $123 million assisted living facility in Milwaukee WI.

At Gerdau we regularly monitor the strong relationship established between the Dodge Momentum Index and actual non-residential construction spending one here hence. This is a valuable leading indicator for planning purposes for construction industry professionals including you our valued customers.