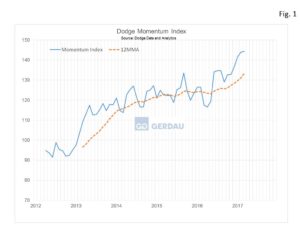

Dodge Momentum Index

The Dodge momentum index moved up 1.2 points or 0.9% in March. The index has now advanced for six consecutive months. The index predicts non-residential construction activity approximately 12 months out. The Institutional sub-index moved up 4.3% to an all-time high of 138.3, besting last month’s all-time high. The commercial sub-index fell to 149.4, off 1.9% in March, its third consecutive monthly decline

Figure 1 presents the Dodge momentum index and its 12 month moving average (12MMA) from 2012 to present. On this basis, the index has been trending higher since mid-2015, a very encouraging sign for future growth in non-residential construction.

Figure 1 presents the Dodge momentum index and its 12 month moving average (12MMA) from 2012 to present. On this basis, the index has been trending higher since mid-2015, a very encouraging sign for future growth in non-residential construction.

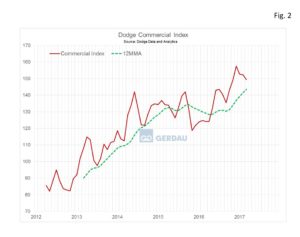

Figure 2 breaks out the commercial sub-index and its 12MMA. The commercial sub-index has rolled back after a four month climb, yet shows a steady advance when viewed on a 12MMA basis.

Figure 2 breaks out the commercial sub-index and its 12MMA. The commercial sub-index has rolled back after a four month climb, yet shows a steady advance when viewed on a 12MMA basis.

Figure 3 shows the Institutional sub-index and its 12MMA. It shows a lot more volatility than the private sector dominated commercial segment. Since the onset of 2017, the institutional momentum index has taken off, rising 27.4 points since the end of last year. Dodge reports that institutional planning is 23% higher than last year.

Dodge reports that in March eight new projects entered the planning stage with a total value greater than $100 million. Within the commercial sector the leading projects were the $200 million Universal Orlando Resort in Orlando FL and a $150 million office building in Clayton MO. The leading institutional project was a $500 million medical complex in Chicago IL.

Dodge reports that in March eight new projects entered the planning stage with a total value greater than $100 million. Within the commercial sector the leading projects were the $200 million Universal Orlando Resort in Orlando FL and a $150 million office building in Clayton MO. The leading institutional project was a $500 million medical complex in Chicago IL.

At Gerdau we regularly monitor the strong relationship established between the Dodge Momentum Index and actual non-residential construction spending. This is a valuable leading indicator for planning purposes for construction industry professionals including you our valued customers.