Currency Report

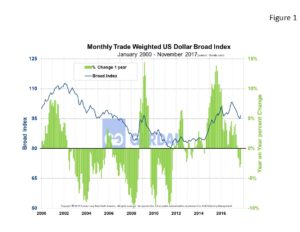

On a three moving average, (3MMA) y/y comparison, the dollar was down 2.6% against the Broad Index. The dollar Broad Index was 98.68 on November 1st, it has traded in a range of 95.00, (9/1/2017) to 103.09, (1/12017) over the past 12 months.

Figure 1 shows the track of the Broad Index from 2000 to present. After falling for seven consecutive months the U.S. Dollar Broad index traded up 1.8% month on month, (m/m) as of November 1st.

Figure 1 shows the track of the Broad Index from 2000 to present. After falling for seven consecutive months the U.S. Dollar Broad index traded up 1.8% month on month, (m/m) as of November 1st.

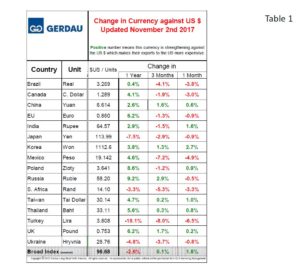

Table 1  lists the values of the U.S. dollar measured in the currency of the 16 steel trading nations that we follow as of November 2nd. It reports the changes in, one year, 3 months and one month for each currency and is color coded to indicate strengthening of the dollar in red and weakening in green.

lists the values of the U.S. dollar measured in the currency of the 16 steel trading nations that we follow as of November 2nd. It reports the changes in, one year, 3 months and one month for each currency and is color coded to indicate strengthening of the dollar in red and weakening in green.

Nine of the 16 countries’ currencies have lost value against the dollar over the past month ranging from -6.5% for the Turkish Lira to -0.9% for both the Japanese Yen and the Euro.

Currencies gaining against the dollar include the Korean Won, +2.7%, the Indian Rupee, the Taiwan Dollar, +1.0%, the Thailand Baht, +0.8% the Polish Zloty, +0.9%, United Kingdom’s Pound, +0.2% and the Chinese Yuan, 0.6%.

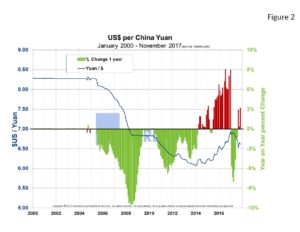

Figure 2  illustrates the history of the Chinese Yuan against the dollar from 2000 to present and the year on year change.

illustrates the history of the Chinese Yuan against the dollar from 2000 to present and the year on year change.

Imported goods to include long product steel are heavily influenced by currency exchange. The correlation coefficient between net long product imports and the Broad Index from 1995 to present is 0.692, a fairly strong relationship. In the news today the dollar fell as the U.S. House of Representatives revealed its tax reform proposal. The proposal would slash the corporate tax rate from 35% to 20% and reduce the number of tax brackets for individuals. Cutting taxes is expected to increase spending and drive inflation and U.S. interest rates higher, making the dollar more attractive. A falling dollar is good news for steel companies and manufacturers that export.

The dollar did not have much of a reaction to the announcement from the Trump administration that Jerome Powell, a republican would take-over for Janet Yellen in February 2018 when her term expires. The market expects the Fed to announce an interest rate hike in December and for Powell to embark on a path of gradual interest rate hikes in 2018 as well as continuing to pare back its massive balance sheet of Treasury notes and bonds.

At Gerdau, we keep a close eye on the currency market because it has a profound impact on both the import and export of raw materials, semi-finished and finished steel. A strengthening USD is a “double-edged sword”, as it makes the US market more attractive other countries to export to the US and conversely imposes strong head-winds for the US to export its products to other nations.