Currency Report

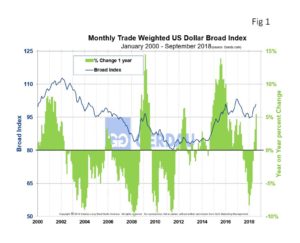

The dollar Broad Index posted a reading of 100.92 for September, up 1.7% month on month. On a twelve moving average, (12MMA) year on year, (y/y) comparison, the dollar was down 1.6% against the Broad Index.

Figure 1 shows the track of the Broad Index from 2000 to present. Year on year, the U.S. Dollar Broad index has fallen on a percentage basis for eleven consecutive months.

Figure 1 shows the track of the Broad Index from 2000 to present. Year on year, the U.S. Dollar Broad index has fallen on a percentage basis for eleven consecutive months.

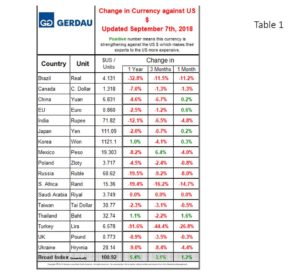

Table 1 lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of September 7th. It reports the changes in, one year, 3 months and one month for each currency.

lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of September 7th. It reports the changes in, one year, 3 months and one month for each currency.

Over a three month basis, only one country gained value against the U.S. dollar. Over the last month, the seven countries gained value. The Brazilian Real, Turkish Lira, and South African Rand each lost over ten percent against the dollar. Conversely the Thailand Baht, European Euro, and Korean Won strengthened against the dollar, rising 1.6%, 0.6% and 0.3% respectfully.

Referencing Reuter’s news, the decline in the Turkish lira has led to Turkey requiring exporters to convert the bulk of their overseas revenue into lira, a surprise move designed to support the tumbling currency, but one that industry officials say could lead to losses for manufacturers.

At Gerdau, we keep a close eye on the currency market because it has a profound impact on both the import and export of raw materials, semi-finished and finished steel. A strengthening USD is a “double-edged sword”, as it makes the U.S. market more attractive other countries to export to the U.S. and conversely imposes strong head-winds for the U.S. to export its products to other nations.