Currency Report

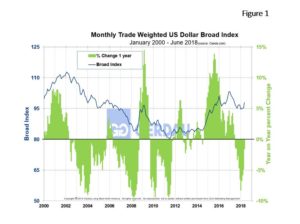

The dollar Broad Index posted a reading of 97.95 for May, up 2.7% month on month. On a twelve moving average, (12MMA) year on year, (y/y) comparison, the dollar was down 1.6% against the Broad Index.

Figure 1 shows the track of the Broad Index from 2000 to present. Year on year, the U.S. Dollar Broad index has fallen on a percentage basis for eleven consecutive months.

Figure 1 shows the track of the Broad Index from 2000 to present. Year on year, the U.S. Dollar Broad index has fallen on a percentage basis for eleven consecutive months.

Table 1 lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of June 13th. It reports the changes in, one year, 3 months and one month for each currency.

lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of June 13th. It reports the changes in, one year, 3 months and one month for each currency.

Over a three month basis, all but seven gained value against the U.S. dollar. Over the last month, the U.S. currency gained back some lost ground as 10 of the 17 currencies fell against the dollar. The Brazilian Real, Mexican Peso, and Turkish Lira each lost over ten percent against the dollar. Conversely the Chinese Yuan, Korean Won, and Thailand Baht strengthened considerably against the dollar, rising 6.3%, 5.0 and 5.5% respectfully.

Referencing Reuter’s news, the euro declined despite worries about a global trade war following a spat at the Group of Seven summit in Canada between U.S. President Donald Trump and other leaders over automobile tariffs and other issues. Analysts said the fairly muted reaction in currencies reflected the low expectations markets had for the G7 summit, despite the fact that the euro is sensitive to the threat of U.S. tariffs on cars

At Gerdau, we keep a close eye on the currency market because it has a profound impact on both the import and export of raw materials, semi-finished and finished steel. A strengthening USD is a “double-edged sword”, as it makes the U.S. market more attractive other countries to export to the U.S. and conversely imposes strong head-winds for the U.S. to export its products to other nations.