Currency Report

The dollar Broad Index posted a reading of 95.2 for April, relatively flat month on month yet still close to its lowest level in since July of 2015. The rate of decline has moderated over the past month likely because of the FEDs indication that there will be three and perhaps four interest rate hikes this year. On a twelve moving average, (12MMA) year on year, (y/y) comparison, the dollar was down 4.9% against the Broad Index.

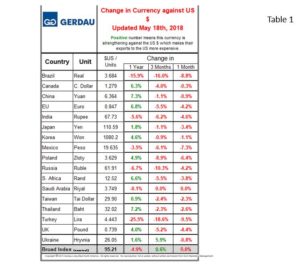

Table 1 lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of May 18th. It reports the changes in, one year, 3 months and one month for each currency.

Table 1 lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of May 18th. It reports the changes in, one year, 3 months and one month for each currency.

Over a three month basis, all but one currency (Ukraine Hryvnia) gained value against the U.S. dollar. Over the last month, the U.S. currency gained back some lost ground as all of the 17 currencies fell against the dollar. The biggest losses against the U.S. dollar m/m is the Turkish Lira, Brazilian Real, and Mexican Peso, which lost 9.5%, 8.8% and 7.3 respectively. The Euro also lost against the U.S. dollar by 4.2% m/m.

Referencing Reuter’s news, the weakened Euro is due to the concerns of a new governing coalition in Italy which aims to secure billions of euros for tax cuts and welfare, causing investors to become weary. According to the Wall Street Journal, the U.S. dollar fell as the U.S. government bond yields declined, subsequent of the geopolitical unease. U.S. President Donald Trump also used proposed tariffs on steel and aluminum as a bargaining chip in talks to revamp NAFTA. Trump is expected to finalize the tariffs later in the week. Trump appeared to tie possible exemptions for Canada and Mexico to a "new" North American Free Trade Agreement as well as other steps. Canada is the largest supplier of both steel and aluminum to the United States. Its commodity-linked economy could be hurt if NAFTA were to collapse or if more protectionist trade policies were to lead to a slowdown in global trade.

At Gerdau, we keep a close eye on the currency market because it has a profound impact on both the import and export of raw materials, semi-finished and finished steel. A strengthening USD is a “double-edged sword”, as it makes the U.S. market more attractive other countries to export to the U.S. and conversely imposes strong head-winds for the U.S. to export its products to other nations.