Currency Report

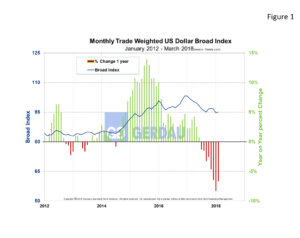

The dollar Broad Index posted a reading of 94.05 for February, up 0.4% month on month yet still close to its lowest level in two years. The rate of decline has moderated over the past month likely because of the FEDs indication that there will be three and perhaps four interest rate hikes this year. On a twelve moving average, (12MMA) year on year, (y/y) comparison, the dollar was down 6.6% against the Broad Index.

Figure 1 shows the track of the Broad Index from 2000 to present. Year on year, the U.S. Dollar Broad index has fallen on a percentage basis for eight consecutive months.

Figure 1 shows the track of the Broad Index from 2000 to present. Year on year, the U.S. Dollar Broad index has fallen on a percentage basis for eight consecutive months.

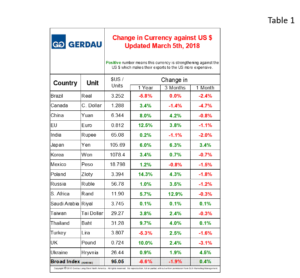

Table 1  lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of March 5th. It reports the changes in, one year, 3 months and one month for each currency.

lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of March 5th. It reports the changes in, one year, 3 months and one month for each currency.

Over a three month basis, all but three currencies (Mexican Peso, Canadian dollar and Indian Rupee) gained value against the U.S. dollar. Over the last month, the U.S. currency gained back some lost ground as 13 of the 17 currencies fell against the dollar. The Canadian dollar and U.K. pound each lost over three percent against the dollar. Conversely the Ukraine Hryvnia and Japanese Yen strengthened considerably against the dollar, rising 4.5% and 3.4% respectfully.

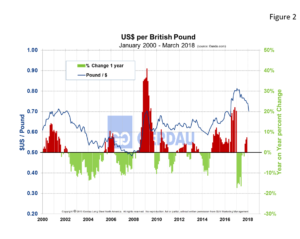

Figure 2 illustrates the history of the U.K. pound against the dollar from 2000 to present and the year on year change. In recent times, the pound hit a low of 0.8132 $U.S. per U.K pound on January 2017. It has been rising since then, reaching 0.7028 as of today. The strengthening pound is a result of a comment by British Prime Minister Theresa May who said she was close to securing a transition deal with the European Union.

Figure 2 illustrates the history of the U.K. pound against the dollar from 2000 to present and the year on year change. In recent times, the pound hit a low of 0.8132 $U.S. per U.K pound on January 2017. It has been rising since then, reaching 0.7028 as of today. The strengthening pound is a result of a comment by British Prime Minister Theresa May who said she was close to securing a transition deal with the European Union.

Referencing Reuters news, The Canadian dollar weakened to a nearly eight-month low against its U.S. counterpart on Monday after U.S. President Donald Trump used proposed tariffs on steel and aluminum as a bargaining chip in talks to revamp NAFTA. Trump is expected to finalize the tariffs later in the week. Trump appeared to tie possible exemptions for Canada and Mexico to a "new" North American Free Trade Agreement as well as other steps. Canada is the largest supplier of both steel and aluminum to the United States. Its commodity-linked economy could be hurt if NAFTA were to collapse or if more protectionist trade policies were to lead to a slowdown in global trade.

At Gerdau, we keep a close eye on the currency market because it has a profound impact on both the import and export of raw materials, semi-finished and finished steel. A strengthening USD is a “double-edged sword”, as it makes the U.S. market more attractive other countries to export to the U.S. and conversely imposes strong head-winds for the U.S. to export its products to other nations.