Currency Report

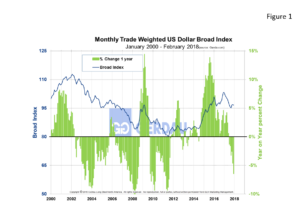

The dollar Broad Index posted a reading of 94.35 on February 2nd, its lowest point since June 2015. Over the past 12 months, the dollar broad index has ranged between 94.35, (today) and 101.88, (February 2017). On a twelve moving average, (12MMA) year on year, (y/y) comparison, the dollar was down 8.6% against the Broad Index.

Figure 1 shows the track of the Broad Index from 2000 to present. The U.S. Dollar Broad index has fallen month on month, (m/m) in 10 of the last 12 months.

Figure 1 shows the track of the Broad Index from 2000 to present. The U.S. Dollar Broad index has fallen month on month, (m/m) in 10 of the last 12 months.

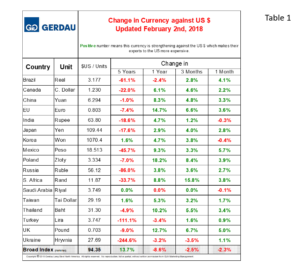

Table 1 lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of February 2nd. It reports the changes in, one year, 3 months and one month for each currency.

lists the values of the U.S. dollar measured in the currency of the 17 steel trading nations that we follow as of February 2nd. It reports the changes in, one year, 3 months and one month for each currency.

Just three of the 17 countries’ currencies have lost value against the dollar over the past month. These include the Indian Rupee, (-0.3%), the Saudi Arabian Riyal, (-0.1%) and the Korean Won, (-0.4%). Each of the remaining 14 currencies gained value against the dollar, ranging from +0.9% for the Turkish Lira to +5.4% for the Mexican Peso. Over a one year period, three countries lost value against the dollar including: The Brazilian Real, (-2.4%), Turkish Lira, (-3.4%) and the Ukraine Hryvnia, (-3.4%). Each of the remaining 14 currencies gained value, ranging from +2.9 for the Japanese Yen to +18.2% for the Polish Zloty. Other notables include the Euro, up 14.7% y/y, the Thailand Baht, up 10.2% y/y and the U.K. Pound, up 12.7% y/y.

Figure 2 illustrates the history of the Chinese Yuan against the dollar from 2004 to present and the year on year change. In recent times, the Yuan hit a high of 6.933 on December 2016. It has been on a freefall since then, reaching 6.294 as of today.

illustrates the history of the Chinese Yuan against the dollar from 2004 to present and the year on year change. In recent times, the Yuan hit a high of 6.933 on December 2016. It has been on a freefall since then, reaching 6.294 as of today.

Referencing Reuters news, the dollar posted its biggest monthly decline in January since March 2016. The dollar has struggled this year as expected monetary policy-tightening in other parts of the world, along with stronger global economic growth, encouraged investors to put more of their money elsewhere, particularly the euro zone. Supported by a survey on Thursday that showed euro zone manufacturing was booming, the single currency reached a three-year high above $1.25 in January and ended the month up 3.54% amid expectations that the European Central Bank would begin normalizing monetary policy this year. “Unless there’s any sort of significant news or development that would suggest a reason to start buying dollars, I think the market is content in buying euros for the time being, or at least remaining long on euros,” said Mazen Issa, senior FX strategist at TD Securities in New York.

At Gerdau, we keep a close eye on the currency market because it has a profound impact on both the import and export of raw materials, semi-finished and finished steel. A strengthening USD is a “double-edged sword”, as it makes the U.S. market more attractive other countries to export to the U.S. and conversely imposes strong head-winds for the U.S. to export its products to other nations.