Consumer Credit

Total consumer credit increased by $20.50 billion, (B) in October, well above analysts’ expectations for the second month in row. Analyst projections for October were for $17.6B. The increase in October was the largest monthly increase since November 2016, when it rose by $24.5 billion. Non-revolving credit moved-up by $12.2B, $1.1B more than in September. Revolving credit advanced by $8.3B up, $2.3B higher than September and on the heels of a $6.0B increase in September.

On a percentage year on year basis, consumer credit increased at a annual rate of 5.3%. Revolving credit increased at an annual rate of 5.9% percent, while nonrevolving credit increased at an annual rate of 5.2% percent.

Consumer credit represents loans for households, for financing consumer purchases of goods and services, and for refinancing existing consumer debt. Secured and unsecured loans are included, except those secured with real estate (such as mortgages and home equity loans and lines). The two categories of consumer credit are revolving and nonrevolving debt. Revolving debt covers credit card use for purchases or cash advances, store charge accounts. Nonrevolving includes auto loans, personal and student loans and other miscellaneous items such as recreation vehicle loans.

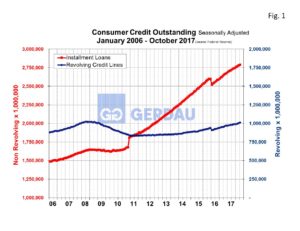

Figure 1 shows consumer credit outstanding from 2006 to present. The blue line represents revolving credit, while installment loans, is illustrated by the red line. Consumers have been more careful with revolving credit since the great recession, the current level is just now reaching the peak achieved in 2008.

Figure 1 shows consumer credit outstanding from 2006 to present. The blue line represents revolving credit, while installment loans, is illustrated by the red line. Consumers have been more careful with revolving credit since the great recession, the current level is just now reaching the peak achieved in 2008.

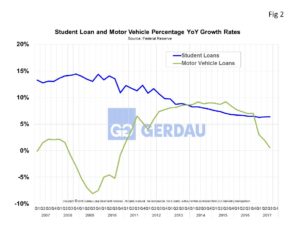

Figure 2  show both student loans and auto loans on the same chart from 2007 to present. The Y axis is year on year percentage change. The percentage change for student loan has moderated over the time horizon shown. Jobs were and remain more plentiful since the recession ended, thus fewer students took on debt. Auto loans ramped up sharply after the recession ended as workers felt confident about their future and replaced worn out vehicles. The percentage change has dropped sharply thus far in 2017 for two reasons. A level of saturation in new car replacement has been achieved and perhaps more impactful, banks have reined-in sub-prime loans commitments.

show both student loans and auto loans on the same chart from 2007 to present. The Y axis is year on year percentage change. The percentage change for student loan has moderated over the time horizon shown. Jobs were and remain more plentiful since the recession ended, thus fewer students took on debt. Auto loans ramped up sharply after the recession ended as workers felt confident about their future and replaced worn out vehicles. The percentage change has dropped sharply thus far in 2017 for two reasons. A level of saturation in new car replacement has been achieved and perhaps more impactful, banks have reined-in sub-prime loans commitments.

Consumers are confident in the economy and thus are willing to take on debt to finance their purchases. Nonrevolving credit continues to advance more quickly than the revolving segment, but both are maintaining a steady upward climb. Despite the increase in consumer loans, debt burdens are near record lows. Delinquency and default rates remain close to historic lows and the savings rate is healthy such that the consuming public could further increase spending/borrowing without significant financial strain.

Risks on the horizon include the uncertainty surrounding the healthcare marketplace and tax policy. These worries may cause business and consumers to restrain or delay large purchases and investments. Higher interest rates could also present challenges since debt servicing will rise on revolving credit, while higher borrowing costs will inhibit growth in both the home mortgage and auto markets.

At Gerdau, we monitor consumer spending because history has shown that increased consumer spending (approximately 69% of GDP), translates into increased steel consumption (and vice versa).