Consumer Credit

Consumer credit continued to climb but the pace of growth has slowed somewhat. Total consumer credit increased by $13.9 billion, (B) in January, well below the consensus estimate of $17.8B. Non-revolving credit advanced by $13.2B or 95% of the gain, while revolving credit moved-up by just $0.7B, its lowest level since July 2103.

On a percentage year on year basis, consumer credit increased at an annual rate of 4.3%. Revolving credit increased at an annual rate of 0.8% percent, while nonrevolving credit increased at an annual rate of 5.8% percent.

Consumer credit represents loans for households, for financing consumer purchases of goods and services, and for refinancing existing consumer debt. Secured and unsecured loans are included, except those secured with real estate (such as mortgages and home equity loans and lines). The two categories of consumer credit are revolving and nonrevolving debt. Revolving debt covers credit card use for purchases or cash advances, store charge accounts. Nonrevolving includes auto loans, personal and student loans and other miscellaneous items such as recreation vehicle loans.

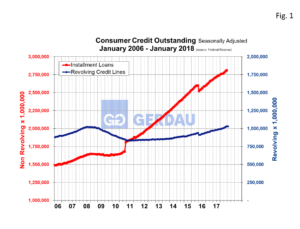

Figure 1 shows consumer credit outstanding from 2006 to present. The blue line represents revolving credit, while installment loans, is illustrated by the red line. Consumers have been very careful with revolving credit since the great recession, the current level is just now reaching the peak achieved in 2008. Growth in revolving credit balances decelerated intensely in January, coming in at just $700 million. This was the smallest gain since February 2015. For reference, December’s value was $6.1 billion.

Figure 1 shows consumer credit outstanding from 2006 to present. The blue line represents revolving credit, while installment loans, is illustrated by the red line. Consumers have been very careful with revolving credit since the great recession, the current level is just now reaching the peak achieved in 2008. Growth in revolving credit balances decelerated intensely in January, coming in at just $700 million. This was the smallest gain since February 2015. For reference, December’s value was $6.1 billion.

Installment credit is steadily climbing at the same slope as consumers continue to spend freely as their confidence in the economy is high. Consumers have the ability to take on additional debt as the current level of debt burden is near its lowest level in 35 years. In addition delinquency and default rates are also at historically low rates.

Risks on the horizon include the uncertainty surrounding the healthcare marketplace and geopolitical tensions. Higher interest rates could also present challenges since debt servicing will rise on revolving credit, while higher borrowing costs will inhibit growth in both the home mortgage and auto markets. Home mortgage rates are now at the highest level in four years, 4.46% for a 30 year fixed rate according to data from Freddie Mac. The rate at the start of the year was 3.95%.

At Gerdau, we monitor consumer spending because history has shown that increased consumer spending (approximately 69% of GDP), translates into increased steel consumption (and vice versa).