Consumer Confidence

The Consumer confidence index surged 6.5 points in February according to the Conference Board. The index now stands at 130.8, its highest level in a year. Business conditions are reportedly strong and consumers feel good about the job market and the economy. On a year over year comparison, the 3MMA composite index was up 14.7 points or 12.7%.

The Consumer Confidence Survey measures the level of confidence individual households have in the performance of the economy. Survey asks a nationwide representative sample of 5,000 households, of which approximately 3,500 responses. Households are asked five questions that include (1) a rating of business conditions in the households area, (2) a rating of business conditions in six months, (3) job availability in the area, (4) job availability in six months, and (5) family income in six months that go into the top line index.

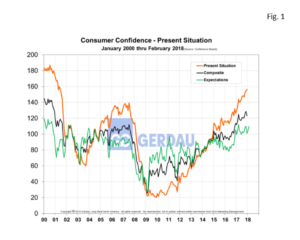

Figure 1 shows the Composite, Present and Expectation indexes from 2000 to present. The Present Situation score jumped 7.7 point month on month, (m/m) to 162.4 and was stronger by 27.7 points or 20.8% y/y. The Expectation score advanced 5.7 points m/m to 109.7. Looked at on a y/y basis, the expectation index was up 7.4 points or 7.2%.

Figure 1 shows the Composite, Present and Expectation indexes from 2000 to present. The Present Situation score jumped 7.7 point month on month, (m/m) to 162.4 and was stronger by 27.7 points or 20.8% y/y. The Expectation score advanced 5.7 points m/m to 109.7. Looked at on a y/y basis, the expectation index was up 7.4 points or 7.2%.

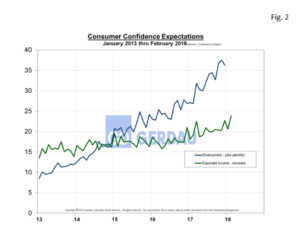

Figure 2  chart two sub-indexes, 1] Employment – jobs plentiful, (blue-line) and 2] Expected income – increase, (green-line). The 3MMA jobs plentiful index gained 0.6 point m/m to 37.6%. Those who saw jobs harder to get, (3MMA) fell 0.7 point to 15.7%. The expectation of higher wages index rose 1.2 points to 22.4%, while those expecting an income decrease was up 0.3 point to 8.5%.

chart two sub-indexes, 1] Employment – jobs plentiful, (blue-line) and 2] Expected income – increase, (green-line). The 3MMA jobs plentiful index gained 0.6 point m/m to 37.6%. Those who saw jobs harder to get, (3MMA) fell 0.7 point to 15.7%. The expectation of higher wages index rose 1.2 points to 22.4%, while those expecting an income decrease was up 0.3 point to 8.5%.

The percentage saying business conditions are "good" increased 4.3 points in January to 25.8%. Employment expectations also rose, climbing 2.9 points as 21.6% of the surveyed population expect to see more jobs coming on the market over the next six months. Purchasing plans were mixed, with potential home buyers moving up 0.3 point to 6.3%, appliance buyers gaining 2.4 points to 52.5%. On a down-note auto purchase expectations fell 0.7 point to 12.9% and vacation plans over the next six months dipped to 52.3%.

Inflation expectations over the next 12 months are expected to increase 0.1 point to 4.7%. This answer has ranged from a low of 4.5% to a high of 4.9% over the last eight months. Older and lower-income, ($15,000 to $50,000) households were more likely to score a gain in confidence than other cohorts.

Lynn Franco, Director of Economic Indicators at The Conference Board made the following statement at todays press release: "Consumers' assessment of current conditions was more favorable this month, with the labor force the main driver. Despite the recent stock market volatility, consumers expressed greater optimism about short-term prospects for business and labor market conditions, as well as their financial prospects. Overall, consumers remain quite confident that the economy will continue expanding at a strong pace in the months ahead."

The economy continues to be strong and the major tax cut will spur additional growth over the next couple of years. Unemployment levels are headed down to levels never witnessed before. The concern is that this situation may not be sustainable, that the economy will overheat, resulting in rising prices which will trigger rapid interest rate hikes to cool things down.

At Gerdau we routinely monitor consumer confidence, readily available credit and spending habits since we know that increased consumer spending translates to stronger steel sales and vice versa.