Consumer Confidence

Consumer confidence increased in January as the Conference Board Consumer Confidence Composite Index rose by 2.3 points to 125.4, following a decline in December. On a three month moving average, (3MMA) the composite index measured 125.7, up 0.3 point month on month (m/m). On a year over year comparison, the 3MMA composite index was up 14.1 points or 12.6%.

The Consumer Confidence Survey measures the level of confidence individual households have in the performance of the economy. Survey asks a nationwide representative sample of 5,000 households, of which approximately 3,500 responses. Households are asked five questions that include (1) a rating of business conditions in the household’s area, (2) a rating of business conditions in six months, (3) job availability in the area, (4) job availability in six months, and (5) family income in six months that go into the top line index.

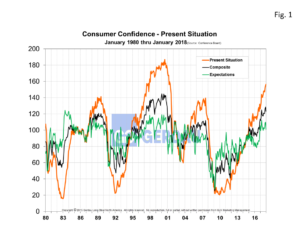

Figure 1 shows the Composite, Present and Expectation indexes from 2005 to present. The Present Situation score was down 1.2 point month on month, (m/m) to 155.3. Despite the minor decline, the Present situation index continues to climb into record territory, rising 19%, 3MMA y/y. The Expectation advanced 4.7 points m/m to 105.5. Looked at on a 3MMA y/y basis, the expectation index was up 6%.

Figure 1 shows the Composite, Present and Expectation indexes from 2005 to present. The Present Situation score was down 1.2 point month on month, (m/m) to 155.3. Despite the minor decline, the Present situation index continues to climb into record territory, rising 19%, 3MMA y/y. The Expectation advanced 4.7 points m/m to 105.5. Looked at on a 3MMA y/y basis, the expectation index was up 6%.

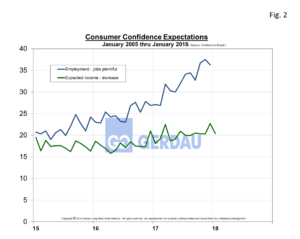

Figure 2 chart two sub-indexes, 1] Employment – jobs plentiful, (blue-line) and 2] Expected income – increase, (green-line). The 3MMA jobs plentiful index gained 0.3 point m/m to 37.1%. Those who saw jobs harder to get, (3MMA) fell 0.2 point to 16.4%. The expectation of higher wages index was unchanged at 21.1%, while those expecting an income decrease, fell 0.1 point to 8.1%. Wage increases have been stubborn thus far in the recovery keeping a lid on inflationary pressures. Historically, (pre-2015) the two lines on Figure 2 each rose at a similar trajectory. Higher productivity via automation, improved communication and enhanced data management are some of the reasons explaining the change.

chart two sub-indexes, 1] Employment – jobs plentiful, (blue-line) and 2] Expected income – increase, (green-line). The 3MMA jobs plentiful index gained 0.3 point m/m to 37.1%. Those who saw jobs harder to get, (3MMA) fell 0.2 point to 16.4%. The expectation of higher wages index was unchanged at 21.1%, while those expecting an income decrease, fell 0.1 point to 8.1%. Wage increases have been stubborn thus far in the recovery keeping a lid on inflationary pressures. Historically, (pre-2015) the two lines on Figure 2 each rose at a similar trajectory. Higher productivity via automation, improved communication and enhanced data management are some of the reasons explaining the change.

The percentage saying business conditions are "good" decreased slightly from 35.8% to 34.9%, while those saying business conditions are "bad" increased slightly, from 11.7% to 12.7%.

Lynn Franco, Director of Economic Indicators at the Conference Board made the following comments at today’s press release: “Consumer confidence improved in January after declining in December. Consumers' assessment of current conditions decreased slightly, but remains at historically strong levels. Expectations improved, though consumers were somewhat ambivalent about their income prospects over the coming months, perhaps the result of some uncertainty regarding the impact of the tax plan. Overall, however, consumers remain quite confident that the solid pace of growth seen in late 2017 will continue into 2018."

At Gerdau we routinely monitor consumer confidence, readily available credit and spending habits since we know that increased consumer spending translates to stronger steel sales and vice versa.