Consumer Confidence

Consumer confidence soared in October as the Conference Board Consumer Confidence Composite Index rose 5.3 points to 125.9 to reach its highest level in 17 years. The composite index three month moving average (3MMA) measured 122.3, up 1.6 points month on month (m/m). On a year over year comparison, the composite index was up 25%.

Supporting the large increase in consumer confidence from the Conference Board were similar strong results from other surveys. The University of Michigan’s consumer sentiment index climbed in October to the strongest since the start of 2004, while the Bloomberg Consumer Comfort Index is near the highest level of the expansion.

The Consumer Confidence Survey measures the level of confidence individual households have in the performance of the economy. Survey asks a nationwide representative sample of 5,000 households, of which approximately 3,500 responses. Households are asked five questions that include (1) a rating of business conditions in the household’s area, (2) a rating of business conditions in six months, (3) job availability in the area, (4) job availability in six months, and (5) family income in six months that go into the top line index.

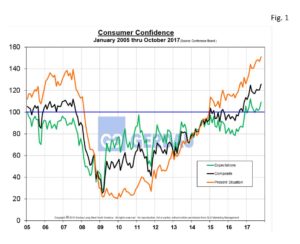

Figure 1 shows the Composite, Present and Expectation indexes from 2005 to present. The Present Situation score was up 4.2 points month on month, (m/m) to 151.1 and the Expectation sub-index surged 6.1 point m/m to 109.1. Consumers remain very confident as evidenced by the soaring Expectation index which advanced 21%, 3MMA y/y. The Present situation index on also is performing admirably, rising 19%, 3MMA y/y, surpassing the highs of the 2006 through 2008 period.

Figure 1 shows the Composite, Present and Expectation indexes from 2005 to present. The Present Situation score was up 4.2 points month on month, (m/m) to 151.1 and the Expectation sub-index surged 6.1 point m/m to 109.1. Consumers remain very confident as evidenced by the soaring Expectation index which advanced 21%, 3MMA y/y. The Present situation index on also is performing admirably, rising 19%, 3MMA y/y, surpassing the highs of the 2006 through 2008 period.

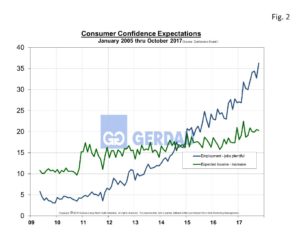

Figure 2 chart two sub-indexes, 1] Employment – jobs plentiful, (blue-line) and 2] Expected income – increase, (green-line). The 3MMA jobs plentiful index was up 3.6 points m/m to 36.3. Those who saw jobs harder to get 3MMA fell 0.5 points to 17.5. The expectation of higher wages index rolled-back 0.2 point to 20.3, while those expecting an income decrease, fell 1.2 points to 7.4. In percentage terms the jobs plentiful index jumped 43.5% y/y, however those expecting a higher income only rose 12.2%. Wage increases have been stubborn thus far in the recovery keeping a lid on inflationary pressures.

chart two sub-indexes, 1] Employment – jobs plentiful, (blue-line) and 2] Expected income – increase, (green-line). The 3MMA jobs plentiful index was up 3.6 points m/m to 36.3. Those who saw jobs harder to get 3MMA fell 0.5 points to 17.5. The expectation of higher wages index rolled-back 0.2 point to 20.3, while those expecting an income decrease, fell 1.2 points to 7.4. In percentage terms the jobs plentiful index jumped 43.5% y/y, however those expecting a higher income only rose 12.2%. Wage increases have been stubborn thus far in the recovery keeping a lid on inflationary pressures.

Business conditions were solid, with 34.5% saying conditions are good, versus 13.5% (saying business conditions are poor. The present condition index is up 28 points from a year earlier.

Purchase intentions were mixed. Consumers planning to purchase an automobile fell 1 point m/m to 13.1%. New appliance purchase expectations fell 4.9 points m/m to 48.9%, while those looking to buy a house rolled-back 1.4 points to 6.0%. At the State-level, consumer confidence remained subdued in Texas and Florida as a lingering result of the hurricanes. The Mountain region on the other hand experienced a surge in confidence that more than offset the weak scores in the gulf and Florida.

The middle-aged cohort, (ages 35 to 54) was the largest contributor to the strong rise in October’s numbers, with some support from those older than 55 cohort. Both of these groups show much stronger confidence y/y. Confidence among the under 35 demographic rolled back this month, on-par with last years’ confidence scores. On an income based look, confidence improved for high-income earners, while those in the $25,000 to $50,000 bracket were generally less confident.

Both consumers and business confidence are high and gaining strength. Economic data continues to be solid with an economy at full employment. The focus is now on tax reform and other policy changes in Washington. Changes to the corporate tax level could have a $2.5 trillion impact to the economy over a 10 year time horizon.

At Gerdau we routinely monitor consumer confidence, readily available credit and spending habits since we know that increased consumer spending translates to stronger steel sales and vice versa.