Construction Put-in-Place, (CPIP):

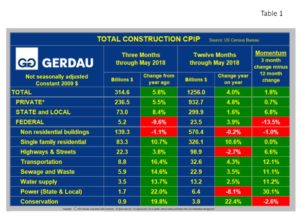

Construction Put-in-Place, (CPIP): Total U.S. construction spending continued to perform well in May, especially in the federal sector. Census Bureau non-seasonally adjusted (NSA), constant dollar CPIP data showed that May’s twelve month total, (12MT) construction expenditures grew by 4.0% year on year (y/y), to $1256.0 billion (B). On a 12MT basis, private expenditures advanced 4.8% y/y, while, State & Local advanced by 1.6% y/y. Non-residential 12MT CPIP decreased by 0.2%, 12MT y/y to $570.4B.

Total Construction: Table 1 presents CPIP data for total construction for both 3 moving total and 12 month moving total y/y metrics. Momentum, defined as 3MT minus 12MT is also shown. Momentum provides market direction with green indicating stronger activity and red indicating slowing activity. Private construction accounted for 75.2% of the total three months expenditures ending in May. State & local spending accounted for 23.2%, the remaining 1.7% was for federally financed projects. The private sector posted 5.5% and 4.8% growth for 3MT and 12MT y/y comparisons resulting in positive 0.7% momentum for the month of May.

presents CPIP data for total construction for both 3 moving total and 12 month moving total y/y metrics. Momentum, defined as 3MT minus 12MT is also shown. Momentum provides market direction with green indicating stronger activity and red indicating slowing activity. Private construction accounted for 75.2% of the total three months expenditures ending in May. State & local spending accounted for 23.2%, the remaining 1.7% was for federally financed projects. The private sector posted 5.5% and 4.8% growth for 3MT and 12MT y/y comparisons resulting in positive 0.7% momentum for the month of May.

Single family residential construction recorded 10.7% growth on a 3MT basis. Nationally there is a significant demand for single family residential homes causing construction to increase. A strong job market, low interest rates and pent-up demand is driving demand. This trend is expected to continue throughout 2018.

On a 3MT basis, State and Local total construction recorded a 8.4% increase in spending. This was the sixth month in a row of positive growth on a 3MT y/y basis, after a string of 18 months of negative numbers. Federal outlays recorded a decrease in 9.6% on a 12MT basis and an increase of 3.9% on a 3MT comparison.

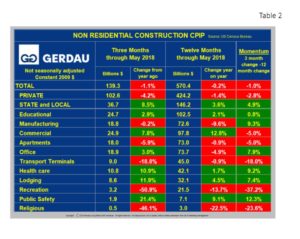

Non-residential Construction:  Table 2 shows the breakdown of non-residential construction (NRC). The overall growth rate was -1.1% on a 3MT y/y basis and -0.2% on a 12MT y/y comparison resulting in a downward 1.0% momentum.

Table 2 shows the breakdown of non-residential construction (NRC). The overall growth rate was -1.1% on a 3MT y/y basis and -0.2% on a 12MT y/y comparison resulting in a downward 1.0% momentum.

The growth rate of private NRC was -4.2% for the 3MT ending May, and the rolling 12MT value was -1.4%, leading to a negative momentum score of -2.8%. State and local expenditures were positive for both 3MT and 12MT metrics. The 3MT y/y increase was +8.5%, stronger than the 3.6%, 12MT y/y growth giving rise to positive momentum of +4.9%. May’s positive percentage posting marks nine consecutive months of growth on 3MT y/y basis and eight months in a row of positive percentage growth on a 12MT y/y comparison.

Sectors that are recording contracting expenditures on both rolling 3MT and 12MT y/y comparisons, include: educational, commercial, health care, lodging, and public safety. Overall the construction industry had a solid performance for the month of May, with significant growth on the Federal level.

At Gerdau we monitor the CPIP numbers every month to keep you, our customers informed on the health of the U.S. construction market.