Construction Put-in-Place, (CPIP):

Total U.S. construction spending continued to perform well in January, especially in the public sector. Census Bureau non-seasonally adjusted (NSA), constant dollar CPIP data showed that January’s twelve month total, (12MT) construction expenditures grew by 3.7% year on year (y/y), to $1232.7 billion (B). On a 12MT basis, private expenditures advanced 5.5% y/y, while, State & Local contracted by 1.4% y/y. Non-residential 12MT CPIP increased by 1.6%, 12MT y/y to $571.2B.

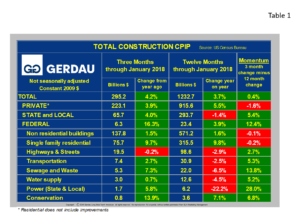

Total Construction: Table 1 presents CPIP data for total construction for both 3 moving total and 12 month moving total y/y metrics. Momentum, defined as 3MT minus 12MT is also shown. Momentum provides market direction with green indicating stronger activity and red indicating slowing activity. Private construction accounted for 74.3% of the total three months expenditures ending in January. State & local spending accounted for 23.8%, the remaining 1.9% was for federally financed projects. The private sector posted 3.9% and 5.5% growth for 3MT and 12MT y/y comparisons resulting in negative 1.6% momentum for the month of January.

Total Construction: Table 1 presents CPIP data for total construction for both 3 moving total and 12 month moving total y/y metrics. Momentum, defined as 3MT minus 12MT is also shown. Momentum provides market direction with green indicating stronger activity and red indicating slowing activity. Private construction accounted for 74.3% of the total three months expenditures ending in January. State & local spending accounted for 23.8%, the remaining 1.9% was for federally financed projects. The private sector posted 3.9% and 5.5% growth for 3MT and 12MT y/y comparisons resulting in negative 1.6% momentum for the month of January.

Single family residential construction recorded 9.7% growth on a 3MT basis, weaker than the 9.8%, 12MT y/y score, resulting in slightly negative momentum of -0.1%. Residential construction is the largest segment, accounting for 46.3% of total construction outlays. Nationally there is a significant undersupply of existing homes causing prices to rise. A strong job market, low interest rates and pent-up demand is driving demand. This trend is expected to continue throughout 2018.

On 12MT basis, State and Local total construction was in the red, down 1.4%. However on a 3MT month y/y basis, State and Local total construction recorded a 4.0% increase in spending. This was the third month in a row of positive growth on a 3MT y/y basis, after a string of 17 months of negative numbers. In a further encouraging sign, momentum was +5.4%. Federal outlays recorded an increase of 3.9% on a 12MT basis and a much stronger +16.3% on a 3MT comparison.

The infrastructure project groups recorded negative growth on a 12MT y/y comparison for all groups except Conservation which was higher by 7.1%. On an optimistic note, every category recorded positive momentum in January except Highways & Streets, indicating that spending is accelerating. Sewage and waste posted a 7.3% 3MT increase vs. -6.5% y/y growth on a 12MT y/y basis. Power (State & Local) and was up 5.8% 3MT y/y after a disappointing -22.2% 12MT y/y posting. Conservation posted positive 3MT and 12MT y/y expenditures measuring; +13.9%, +7.1% and respectfully. Transportation growth measured +2.7%, 3MT increase vs. -2.5% y/y growth on a 12MT y/y basis. After a negative 4.5% 12MT y/y number, Water supply recorded a +0.7% y/y growth on a 3MT y/y metric. Highway and streets recorded negative values for both three and 12 month y/y comparisons, -0.2% and -2.8% respectfully.

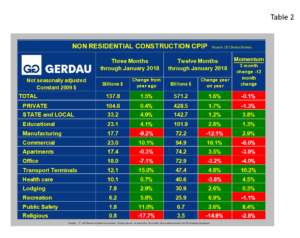

Non-residential Construction: Table 2  shows the breakdown of non-residential construction (NRC). The overall growth rate was +1.5% on a 3MT y/y basis and +1.6% on a 12MT y/y comparison resulting in slightly negative 0.1% momentum.

shows the breakdown of non-residential construction (NRC). The overall growth rate was +1.5% on a 3MT y/y basis and +1.6% on a 12MT y/y comparison resulting in slightly negative 0.1% momentum.

The growth rate of private NRC was +0.4% for the 3MT ending January, less than the rolling 12MT value of +1.7%, leading to a negative momentum score of -1.3%. This is the first positive growth rate for the 3MT y/y metric after a run of four month in a row that the 3MT y/y growth rate has been negative, an encouraging turn-a-round.

State and local expenditures were positive for both 3MT and 12MT metrics. The 3MT y/y increase was +4.9%, stronger than the 1.2%, 12MT y/y growth giving rise to positive momentum of +3.8%. January’s positive percentage posting marks five consecutive months of growth on 3MT y/y basis and four months in a row of positive percentage growth on a 12MT y/y comparison.

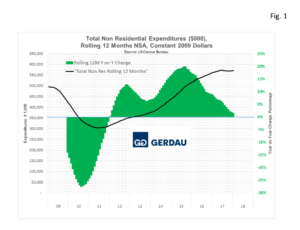

Figure 1 charts the NSA rolling 12MT expenditure history for non-residential construction from 2009 to present. Expenditures (black line) are read on the left Y axis in constant 2009 dollars. The year on year change, (green bars) are read off the right Y axis. Total non-residential expenditures was recently at its highest point since our data began. It has now started to plateau. While expenditures remain at elevated levels, the y/y percentage change is on a continuous downward slope.

Figure 1 charts the NSA rolling 12MT expenditure history for non-residential construction from 2009 to present. Expenditures (black line) are read on the left Y axis in constant 2009 dollars. The year on year change, (green bars) are read off the right Y axis. Total non-residential expenditures was recently at its highest point since our data began. It has now started to plateau. While expenditures remain at elevated levels, the y/y percentage change is on a continuous downward slope.

Looking at the project categories within non-residential buildings, most are exhibiting strong growth while others are declining. Educational, Commercial, Recreation and Transportation Terminals, Lodging, and Public Safety construction all recorded positive growth on both 3MT and 12MT y/y metrics.

Educational structures posted percentage increases of 4.1% for 3MT y/y and 2.8% for 12MT y/y respectfully. Commercial construction continues to perform well, up 10.1%, 3MT y/y and +16.1%, 12MT y/y. Transportation Terminals construction is also performing well, posting a sharp percentage increase on the 3MT comparison at +15.0% vs. the 12MT y/y comparison at 4.8%, leading to a strong momentum score of +10.2%. After a brief slowdown for the three month period ending in November, Lodging construction is once again posting positive growth numbers, up 2.9%, 3MT y/y and +2.6%, 12MT y/y. Values of +5.8% and +6.9% for 3MT y/y and 12MT y/y growth were posted for Recreation projects.

Sectors that are recording contracting expenditures on both rolling 3MT and 12MT y/y comparisons, include: manufacturing buildings, office buildings, and religious structures.

Manufacturing buildings recorded the weakest performance, down 9.2% and 12.1% for 3MT y/y and 12MT y/y respectfully. Three month y/y total expenditures have been in the negative column for 21 months in a row. Prior to that there was a 57 consecutive month period of strong growth in this sector. After a solid performance last year, office construction is starting to wane, off 7.1%, 3MT y/y and -3.2 %, 12MT y/y. Momentum was negative 4.0%. Religious structures, -17.7%, 3MT y/y and -14.9%, 12MT y/y. Religious buildings have recorded negative growth for 17 consecutive months on a 3MT y/y basis.

Healthcare recorded +0.7%, 3MT y/y and -3.8%, 12MT y/y. Apartments (>4 stories) were higher by 3.5% on a 12MT y/y comparison, but recorded a negative 0.3% on a 3MT y/y look.

Overall the construction market continues to perform well exhibiting continuing y/y growth from the private sector. Public sector spending meanwhile has turned from a weakness to a strength over the past six months.

At Gerdau we monitor the CPIP numbers every month to keep you, our customers informed on the health of the U.S. construction market.