Construction Put-in-Place, (CPIP)

Total U.S. construction spending continued to perform well in October, especially in the state and local sector. Census Bureau non-seasonally adjusted (NSA), constant dollar CPIP data showed that October’s twelve month total, (12MT) construction expenditures grew by 6.2% year on year (y/y), to $1296.5 billion (B). On a 12MT basis, private expenditures advanced 5.3% y/y, while, State & Local advanced by 9.1% y/y. Non-residential 12MT CPIP increase by 1.0%, 12MT y/y to $575.0B.

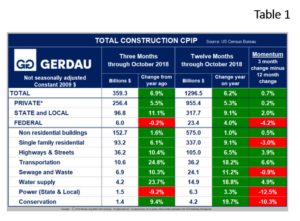

Total Construction:  Table 1 presents CPIP data for total construction for both 3 moving total and 12 month moving total y/y metrics. Momentum, defined as 3MT minus 12MT is also shown. Momentum provides market direction with green indicating stronger activity and red indicating slowing activity. Private construction accounted for 71.3% of the total three months expenditures ending in October. State & local spending accounted for 26.9%, the remaining 1.8% was for federally financed projects. The private sector posted 5.5% and 5.3% growth for 3MT and 12MT y/y comparisons resulting in positive 0.2% momentum for the month of October.

Table 1 presents CPIP data for total construction for both 3 moving total and 12 month moving total y/y metrics. Momentum, defined as 3MT minus 12MT is also shown. Momentum provides market direction with green indicating stronger activity and red indicating slowing activity. Private construction accounted for 71.3% of the total three months expenditures ending in October. State & local spending accounted for 26.9%, the remaining 1.8% was for federally financed projects. The private sector posted 5.5% and 5.3% growth for 3MT and 12MT y/y comparisons resulting in positive 0.2% momentum for the month of October.

Single family residential construction recorded 6.1% growth on a 3MT basis and 9.1% growth on a 12MT basis. Nationally there is a significant demand for single family residential homes causing construction to increase. A strong job market, low interest rates and pent-up demand is driving demand.

On a 3MT basis, State and Local total construction recorded a 11.1% increase in spending. This was the eleventh month in a row of positive growth on a 3MT y/y basis.

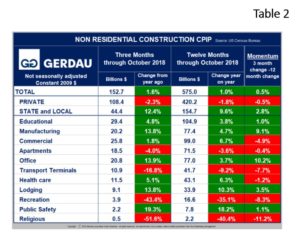

Non-residential Construction: Table 2  shows the breakdown of non-residential construction (NRC). The overall growth rate was 1.6% on a 3MT y/y basis and 1.0% on a 12MT y/y comparison resulting in a upward 0.5% momentum.

shows the breakdown of non-residential construction (NRC). The overall growth rate was 1.6% on a 3MT y/y basis and 1.0% on a 12MT y/y comparison resulting in a upward 0.5% momentum.

The growth rate of private NRC was -2.3% for the 3MT ending October, and the rolling 12MT value was -1.8%, leading to a negative momentum score of -0.5%. State and local expenditures were positive for both 3MT and 12MT metrics. The 3MT y/y increase was +12.4%, stronger than the 9.6%, 12MT y/y growth giving rise to positive momentum of +2.8%.

Economists from the BDC Network comment on the construction segment in 2019, “Given the ongoing shortage of available, skilled construction workers, that is likely to continue into 2019. However, materials price dynamics could be far different given a slowing global economy and expectations for a strong U.S. dollar next year.”

At Gerdau we monitor the CPIP numbers every month to keep you, our customers informed on the health of the U.S. construction market.