Construction Put-in-Place

Census Bureau non-seasonally adjusted (NSA), constant dollar CPIP data showed that August total construction expenditures grew by 3.9% year on year (y/y), to $1213.6 billion (B). Private expenditures advanced 6.8% y/y, while, State & Local contracted by 3.9% y/y. Non-residential CPIP increased by 4.5% y/y to $569.8B. The private sector led the way with strong performances in each of: Commercial, Office, Multi-story-residential, Lodging and Recreation. The U.S. construction market continues to perform well having recorded positive growth for 73 consecutive months.

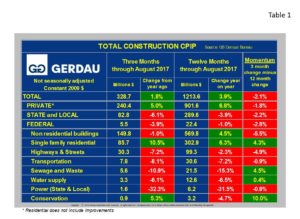

Total Construction:  Table 1 presents CPIP data for total construction for both three and 12 month y/y metrics. Momentum defined as 3 month minus 12 month is also shown. Momentum provides market direction with green indicating stronger activity and red indicating slowing activity. Private construction accounted for 74.2% of the total three months expenditures ending in August. State & local spending accounted for 23.9%, leaving 1.9% for federally financed projects. The private sector posted 5.0% and 6.8% growth for 3 and 12 month y/y comparisons resulting in negative 1.8% momentum for the month.

Table 1 presents CPIP data for total construction for both three and 12 month y/y metrics. Momentum defined as 3 month minus 12 month is also shown. Momentum provides market direction with green indicating stronger activity and red indicating slowing activity. Private construction accounted for 74.2% of the total three months expenditures ending in August. State & local spending accounted for 23.9%, leaving 1.9% for federally financed projects. The private sector posted 5.0% and 6.8% growth for 3 and 12 month y/y comparisons resulting in negative 1.8% momentum for the month.

Single family residential construction recorded 10.3% growth on a three month basis, far stronger than the 6.3 %, 12 month y/y score. A momentum score of 4.3% indicated solid future potential. Nationally there is a significant undersupply of existing homes causing prices rise. A strong jib market, low interest rates and pent-up demand from first time buyers is driving demand.

State and local total construction contracted further this month, off 6.1% on a rolling 12 month basis and down 3.9%, on a three months y/y basis to $82.8B. This growth value been negative for 12 months in a row. Momentum was negative at 2.2%.

The infrastructure project groups recorded negative growth for both 3 and 12 month y/y for most segments. Power (State & Local), for 3 and 12 months y/y respectively was -32.3% and -31.5%. Transportation scored values of -8.1% and -7.2% for 3 and 12 months y/y respectively. Sewage and waste numbers were -10.9% and -15.3%. Water supply recorded values of -6.1% and -6.5%. Conservation posted the only positive number for the group, up 5.3% for 3 months y/y, but down 4.7% on a 12 month comparison. Three groups recorded positive momentum lad by a +10% showing for Conservation and a +4.5% for Sewage and waste.

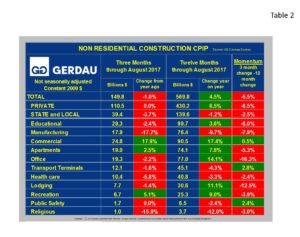

Non-residential Construction: Table 2 shows the breakdown of non-residential construction (NRC). The overall growth rate was negative 1.0% on a 3 month y/y basis and 4.5% on a 12 month y/y comparison resulting in -5.5% momentum.

shows the breakdown of non-residential construction (NRC). The overall growth rate was negative 1.0% on a 3 month y/y basis and 4.5% on a 12 month y/y comparison resulting in -5.5% momentum.

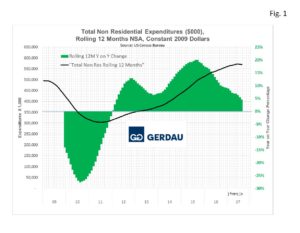

The growth rate of private NRC was flat for the three months ending August, less than the rolling 12 month value of 6.5%, leading to negative momentum of -6.5%.  Figure 1 charts the NSA rolling 12 month expenditure history from 2009 to present. Expenditures (black line) are read on the left Y axis in constant 2009 dollars. The year on year change, (green bars) are read off the right Y axis. Total non-residential expenditures are at the highest level since our history began.

Figure 1 charts the NSA rolling 12 month expenditure history from 2009 to present. Expenditures (black line) are read on the left Y axis in constant 2009 dollars. The year on year change, (green bars) are read off the right Y axis. Total non-residential expenditures are at the highest level since our history began.

Overall the construction market continues to perform well exhibiting continuing y/y growth from the private sector and ongoing slowing growth from the public sector.

Looking at the project categories within non-residential buildings, some are exhibiting strong growth while others are declining. Commercial, apartments (>4 stories), office and recreation construction were the only segments to record growth on both 3 and 12 month rolling total y/y metrics. Commercial construction posted +17.9% y/y growth 3 months y/y and +17.4%, 12 months y/y. Values of +5.1% and +9.0% for 3 and 12 month y/y growth were posted for Recreation projects. After showing recent softening signs over the past few months, Multi-story residential scored respectable growth numbers, up 2.5% and +7.8% for 3 and 12 month y/y respectfully.

Sectors that are recording contracting expenditures on both rolling 3 and 12 month y/y comparisons, include: manufacturing buildings, transport terminals, healthcare, public safety and religious structures. Manufacturing buildings recorded the weakest performance, down 17.7% and 9.7% for 3 and 12 month y/y respectfully. Transport terminals, -6.6%, 3 months y/y and -4.3%, 12 months y/y. Healthcare -5.8%, 3 months y/y and -3.3%, 12 months y/y. Public safety, flat 3 months y/y and -2.4%, 12 months y/y and Religious structures, -15.0%, 3 months y/y and -12.0%, 12 months y/y.

At Gerdau we monitor the CPIP numbers every month to keep you, our customers informed on the health of the US construction market. The present market continues to record solid gains in the private sector, while the public sector continues to underperform.