China Domestic Prices

According to the June 29th China Metals Weekly (CMW) newsletter, prices were up across all product lines on a week on week (w/w), basis. Angles edged up 2.4% to $491 per ton, channels and beams each increased by 0.7% to $484 and $483 respectively. Wire rod priced were up 2.4% to $466 and rebar increased by 0.1% w/w to $466. For reference, hot rolled coil (HRC) was up 0.1% w/w to $415 per ton.

On a month on month, (m/m) comparison, wire rod fell 2.4% and rebar fell 5.5%. This m/m decline came after a 6 month string of higher prices. Channels (+3.3%), beams (3.9%) and angle (+2.7%) all increased on a m/m basis. HRC rose 1.0% m/m.

China Customs reported that the exports of rebar fell by 69.7% m/m in May, while bar and wire-rod exports rose by 30.9% and 6.1% m/m respectfully. For the first five months of the year, rebar exports totaled 96,170 Mt, (+6.3% y/y), wire-rod, 3.09 Mt, (-33.3%) and bars 5.27 Mt, (-62.9% y/y). Exports of large section and medium & small sections were 111,701t and 187,109t respectively in May, up by 38.3% and down by 16.1% m/m. Total exports of large sections and medium & small sections during the first five months were 389,872t, (-6.5% y/y) and 1.249Mt, (-27.3% y/y).

On a y/y appraisal prices were up 48% (ranging from +42% for Beam and Channel to +60% for rebar), on average for longs and 41% for HRC.

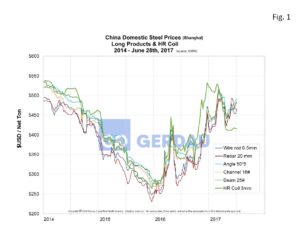

Figure 1 shows the price history per net ton for longs and HRC from 2014 to present. Longs are trending higher while HRC has plateaued in a narrow range.

Figure 1 shows the price history per net ton for longs and HRC from 2014 to present. Longs are trending higher while HRC has plateaued in a narrow range.

CMW reports that China has begun to increase its scrap exports. Scrap exports were 15,400 tonnes (t) in April, just 653t in March but surged to 80,300t in May. For reference, scrap exports for all of 2016 totaled 1,045t. Exports thus far have been isolated to Southeast Asia. CMW says the reason for the increases of scrap exports stems from “de-capacity” action in China. During the process, all intermediate frequency furnaces using scrap to produce inferior steel products are to be closed down before the end of June. The result is expected to reduce steel capacity by about 119Mt. It is reasonable to expect that China’s scrap export will increase over-time since it is now a net scrap generator after many year of expansion. In addition the vast majority of melt capacity is iron based using the Basic Oxygen Furnace, (BOF). Basic Oxygen Furnaces charge about 18 to 24% scrap vs. Electric Arc Furnaces (EAF) that use 100% scrap, (some use a portion of direct reduced iron pellets). Increased Chinese scrap exports will cause a shift in scrap buying patterns on a global basis.

Nationally both scrap and billet prices trended higher w/w with increases in the $10 to $20 per tonne range as inventories declined. Coke prices also inched up $5 to $7 per tonne on decreased inventory. The iron ore market on the other hand remained weak with considerable price variation by region based on quality and ease of availability.

Profit at industrial enterprises increased by 22.6% y/y to RMB2.905 trillion according to the Chinese National Bureau of Statistics, (NBS). Sales revenue increased by 13.5% to RMB48 trillion in the January to May period.

Shipbuilding from January to May totaled 22.93M Deadweight tonnage, (DWT), up 78.8% y/y. However, new orders fell to 9.86M DWT, down 31.5% y/y.

At Gerdau we keep a keen-eye on Chinese steel production and pricing. China produces close 50% of the world’s steel and as a result has a massive influence on global steel trade patterns. Imported steel volume and pricing has an influence on domestic steel so we routinely monitor it.