China Domestic Prices

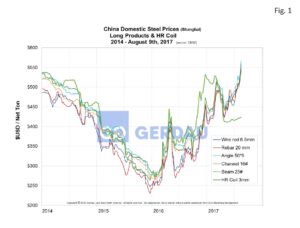

China Metals Weekly (CMW), August 10th newsletter reported that prices moved-up robustly on all product lines on a month over month (m/m), basis. Angles advanced 12.7% to $568 per ton, channels increased by 12.4% to $555. Beams rose 11.6% to $549. Wire rod priced increased 14.7% to $560 and rebar jumped by 12.9% to $545 per ton. Hot rolled coil (HRC) inched up 1.4% to $421 per ton.

On a week on week (w/w), comparison, wire rod moved higher by 5.8% as rebar rose 5.2%. Angles jumped 6.5% as channels increased by 5.3% and beams advanced by 5.4%. HRC were flat, +0.2%. Over a year on year, (y/y) period, long product prices were sharply higher ranging from +48.8% for beams to +67.1% for wire rod. The y/y price increase for HRC was a significantly smaller +10.3%.

Figure 1 shows the price history per net ton for longs and HRC from 2014 to present. Longs are trending higher while HRC has plateaued in a narrow range. Currency is not the reason for the increased pricing. The Yuan has moved very little against the US$. The exchange rate was 6.659 Yuan, (or RMB) per US$ a year ago. The rate was 6.706 Yuan per US$ today, a 0.70% difference.

Figure 1 shows the price history per net ton for longs and HRC from 2014 to present. Longs are trending higher while HRC has plateaued in a narrow range. Currency is not the reason for the increased pricing. The Yuan has moved very little against the US$. The exchange rate was 6.659 Yuan, (or RMB) per US$ a year ago. The rate was 6.706 Yuan per US$ today, a 0.70% difference.

CMW reports that production over the “heating season” will be curtailed by as much as 50% to reduce pollution. Current demand for construction steel in the “hot and rainy” season is not especially strong, however, prices are moving higher on the prospect of reduced future availability. In addition to the proposed volume restrictions, billet prices have moved steadily higher. Billet prices ranged from RMB3,580/t, (US$534/t) to RMB3,700/t, (US$552/t) depending on the region. Most raw material prices are increasing to include: scrap (RMB1,440 to RMB1,800/t = US$215/t to $268/t), pig iron (RMB2,500 to RMB2,880 = US$373/t to US$429/t), iron ore, (62% grade = RMB476 to RMB486/t = US$71/t to US$72/t). Ferro-alloys also inched higher.

CMW reported that according to China customs, the country’s trade surplus reached US$46.736 billion, (B) in July. During the first seven months of 2017, the trade surplus was $231.682B, with import and export values of $1.009 trillion and $1.241 trillion respectively.

Exports of steel products totaled 6.96 million tonnes (Mt), in July, up 150,000 tonnes m/m, down 32.4% y/y. During the first seven months of 2017, exports of steel products totaled 47.95Mt, down 28.7% y/y. Imported steel products totaled just 980,000 tonnes in July, down 150,000 tons m/m. Year to date (YTD), total imports measured 7.79Mt a y/y increase of 2.6%. Therefore net exports YTD were 40.16Mt.

China is witnessing some price inflation. The China consumer price index (CPI) advanced 1.4% y/y through July, with food prices falling by 1.1% and nonfood prices increasing by 2.0%. Chinas’ producer price index (PPI) rose by 5.5% y/y. Raw material inflation was a major contributor, rising 8.5% y/y.

At Gerdau we keep a keen-eye on Chinese steel production and pricing. China produces close 50% of the world’s steel and as a result has a massive influence on global steel trade patterns. Imported steel volume and pricing has an influence on domestic steel so we routinely monitor it.