Chicago Fed National Activity Index

The pace of U.S. economic growth accelerated in September as evidenced by the increased score of the CFNAI. The CFNAI moved-up 0.17 in September after a disappointing -0.37 in August. On a three month moving average, (3MMA) basis the CFNAI remained in negative territory, scoring -0.16, the same score as last month. On a monthly basis, three of the four sub-indexes were positive in September. The Production and Income sub-index posted a +0.10. Employment, unemployment and Hours scored a +0.06. Sales Orders and Inventory moved higher by +0.07. Personal Consumption and Housing sub-index recorded a -0.06.

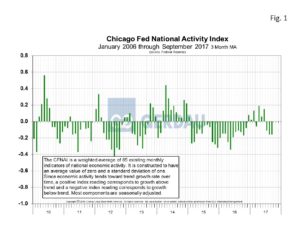

The Chicago Fed National Activity Index is a coincident indicator of broad economic activity. The index is a weighted average of 85 indicators of national economic activity. A zero value for the CFNAI has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Figure 1 shows the 3MMA of the CFNAI from 2010 to present. The CFNAI has been in positive territory for six of the eight months but has struggled with the persistent drag from the Personal Consumption and Housing sub-index.

Figure 1 shows the 3MMA of the CFNAI from 2010 to present. The CFNAI has been in positive territory for six of the eight months but has struggled with the persistent drag from the Personal Consumption and Housing sub-index.

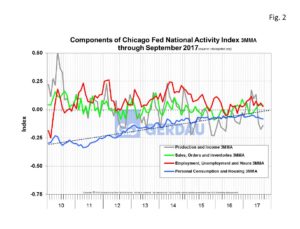

Figure 2 shows the four sub-indexes of the overall CFNAI on a 3MMA basis. On a 3MMA evaluation, the Production and Income sub-index posted a -0.14. Employment, unemployment and Hours scored a +0.03. Sales Orders and Inventory moved higher by +0.04. Personal Consumption and Housing sub-index recorded a -0.08. The personal housing and consumption category continued its streak (129 months), of negative contributions to the CFNAI. The last time this sub-index was positive was in December 2006.

shows the four sub-indexes of the overall CFNAI on a 3MMA basis. On a 3MMA evaluation, the Production and Income sub-index posted a -0.14. Employment, unemployment and Hours scored a +0.03. Sales Orders and Inventory moved higher by +0.04. Personal Consumption and Housing sub-index recorded a -0.08. The personal housing and consumption category continued its streak (129 months), of negative contributions to the CFNAI. The last time this sub-index was positive was in December 2006.

Personal consumption increased in September. Much of it as a result of a surge of vehicle sales to replace flood damaged cars and trucks caused by hurricanes Harvey and Irma. Last month’s housing starts were down a bit, but overall the housing market outlook is positive. Wage pressures are beginning to mount as the economy approaches full employment. More jobs and higher wages will combine to support stronger future home sales allowing more first time buyers to put together a down-payment. Stronger first time buyers are essential to allow move-up buyers to purchase a larger home or second home.

The fundamentals support further gains for manufacturing as data has been very encouraging of late. In addition, industrial production data indicates that it will continue to rise. With the U.S. economy in good shape and the global economy in its best shape in a long time, U.S. manufacturers should see stronger domestic and international demand allowing them to expand production for the foreseeable future.

At Gerdau we follow the CFNAI on a monthly basis since it is one of the broadest measures of the health of the US economy. A healthy and expanding US general economy correlates well to stronger steel consumption.