The Baltic Dry Index

The three month moving average (3MMA), of the Baltic Dry Index (BDI), for September moved-up 16.9% to 1,331 month on month (m/m). The index has moved higher in each of the last four months. On a year on year basis, (y/y), the BDI was 68.4% higher. The BDI has averaged 1,073 over the past 12 months, ranging from a low of 759 to a high of 1,484.

The BDI is a shipping and trade index created by the London-based Baltic Exchange that measures changes in the cost to transport raw materials. The Baltic Dry Index offers a forward view into global supply and demand trends. A rising index can indicate a strengthening global economy. A contracting BDI index signals a slow-down.

The BDI includes three component ships: Capesizes, Panamaxes and Supramaxes. Capesize ships are the largest at >100,000 dead weight tons, (DWT). Capesize vessels make up 10% of the world fleet but account for 62% of dry bulk traffic. Panamaxes account for the vast majority of steel and its raw material freight, they weight in the range of between 60,000 to 80,000 DWT. Panamaxes account for 19% the world fleet and 20% of dry bulk traffic. Supramaxes (35,000 to 59,000 DWT), make-up 37% of the world fleet and combined with the smallest Handyman vessels (15,000 to 35,000 DWT), which account for 34% of the world fleet tally the remaining 18% of dry bulk traffic. Handymaxs are not counted in the BDI index.

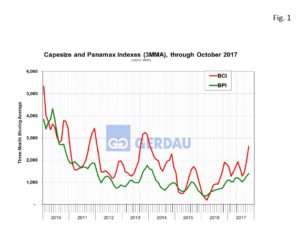

Figure 1 shows the 3MMA for both Capsize and Panamax indexes. These volatile indexes have both been trending higher since early 2016. Despite the recent rise, the BDI is still quite low by historic comparison. The September Capsize (BCI), 3MMA was up 34.5% and up 77.0% y/y. The September Panamax (BPI), 3MMA was up 9.6% and up 90.2% y/y. As a point of reference the BCI is currently 91.7% lower than its peak in April of 2008, while the BPI is down 86.8% from the April 2008 high.

Figure 1 shows the 3MMA for both Capsize and Panamax indexes. These volatile indexes have both been trending higher since early 2016. Despite the recent rise, the BDI is still quite low by historic comparison. The September Capsize (BCI), 3MMA was up 34.5% and up 77.0% y/y. The September Panamax (BPI), 3MMA was up 9.6% and up 90.2% y/y. As a point of reference the BCI is currently 91.7% lower than its peak in April of 2008, while the BPI is down 86.8% from the April 2008 high.

The BDI achieved a three-year high yesterday, as a result of the rally seen among industrial commodities. In particularly, the prices of base metals have rallied, while iron ore prices are hovering around the $60 per metric ton level. The BDI is in its seasonal high shipping cycle where vessels were fixed before the year-end, as iron ore shipments are scheduled much earlier before winter. Thus, Capesize rates have been strong of late. In a promising recent development, China pledged at the 19th National Congress to wipe out poverty by 2020. This means that it would need to average a 6.5% yearly growth rate to achieve this goal. This bodes well for the future need for ocean transportation, in addition to robust worldwide trade.

At Gerdau we regularly monitor the Baltic Dry index since it is a leading indicator of demand for goods on a global scale. An increasing BDI signals stronger global trade which can be good for domestic business if the transactions are fairly traded.