Baltic Dry Index

The three month moving average (3MMA), BDI for June was 1,022, down 8.4%, 3MMA month on month (m/m), but up 66.8%, 3MMA year on year, (y/y).

The BDI is a shipping and trade index created by the London-based Baltic Exchange that measures changes in the cost to transport raw materials. The Baltic Dry Index offers a forward view into global supply and demand trends. A rising index can indicate a strengthening global economy. A contracting BDI index signals a slow-down.

The BDI includes three component ships: Capesizes, Panamaxes and Supramaxes. Capesize ships are the largest at >100,000 dead weight tons, (DWT). Capesize vessels make up 10% of the world fleet but account for 62% of dry bulk traffic. Panamaxes account for the vast majority of steel and its raw material freight, they weight in the range of between 60,000 to 80,000 DWT. Panamaxes account for 19% the world fleet and 20% of dry bulk traffic. Supramaxes (35,000 to 59,000 DWT), make-up 37% of the world fleet and combined with the smallest Handyman vessels (15,000 to 35,000 DWT), which account for 34% of the world fleet tally the remaining 18% of dry bulk traffic. Handymaxs are not counted in the BDI index.

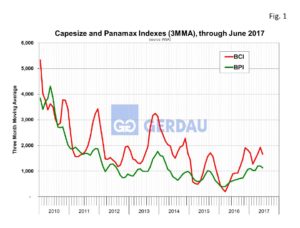

Figure 1 shows the 3MMA for both Capsize and Panamax indexes. These volatile indexes both rolled back a bit of late, but have been trending-up since early 2016. Despite the recent rise, the BDI is still low by historic comparison.

Figure 1 shows the 3MMA for both Capsize and Panamax indexes. These volatile indexes both rolled back a bit of late, but have been trending-up since early 2016. Despite the recent rise, the BDI is still low by historic comparison.

Most analysts are expecting the BDI’s downward move to continue based on the expectation that China’s infrastructure building will slow. Contradicting this projection, Bloomberg reported today that: “Open interest on the Shanghai Futures Exchange’s steel reinforcement bar contract surged to a record 2.82 million lots on Monday, according to bourse data, with each lot representing 10 metric tons of metal. That’s more than double the level at the start of the year, with investors piling up positions in the past two weeks as prices rallied amid renewed optimism on demand. Rebar’s benchmark October contract returned to a bull market on Monday after rising more than 20 percent from this year’s low in mid-April.”

The article goes onto say that the market is much divided between the bulls and the bears. The bulls bet that construction steel (rebar, structurals), will perform will in the coming months as the Purchasers Manager Index (PMI), has expanded for two consecutive months. Supporting this argument are smaller steel inventories, including rebar inventories at the lowest level since December. According to Bloomberg, the price of Chinese rebar was 3,420 yuan per ton today, (approximately $503 per ton,) up 1.8% to its highest point since March 17th. As a point of interest, China produced 202 million tons of rebar last year, according to Beijing Antlike Information Development Co.

The relevance to the BDI is that China is the 800 pound gorilla when it comes to seaborne trade. If China’s economy stalls it would send the BDI into a tailspin.

At Gerdau we regularly monitor the Baltic Dry index since it is a leading indicator of demand for goods on a global scale. An increasing BDI signals stronger global trade which can be good for domestic business if the transactions are fairly traded.