The Baltic Dry Index

The Baltic Dry Index (BDI), for April 2019 increased 95 points to 775 month on month (m/m), a 14% increase. Looked at on a three month moving average, (3MMA) comparison the BDI fell 2.0% to 695 m/m. On a 3MMA year on year basis, (y/y), the BDI was 31.2% lower. The BDI has averaged 1,201 over the past 12 months, ranging from a low of 629 in February to a high of 1,710 in August.

The BDI is a shipping and trade index created by the London-based Baltic Exchange that measures changes in the cost to transport raw materials. The Baltic Dry Index offers a forward view into global supply and demand trends. A rising index can indicate a strengthening global economy. A contracting BDI index signals a slow-down.

The BDI includes three component ships: Capesizes, Panamaxes and Supramaxes. Capesize ships are the largest at >100,000 dead weight tons, (DWT). Capesize vessels make up 10% of the world fleet but account for 62% of dry bulk traffic. Panamaxes account for the vast majority of steel and its raw material freight, they weight in the range of between 60,000 to 80,000 DWT. Panamaxes account for 19% the world fleet and 20% of dry bulk traffic. Supramaxes (35,000 to 59,000 DWT), make-up 37% of the world fleet and combined with the smallest Handyman vessels (15,000 to 35,000 DWT), which account for 34% of the world fleet tally the remaining 18% of dry bulk traffic. Handymaxs are not counted in the BDI index.

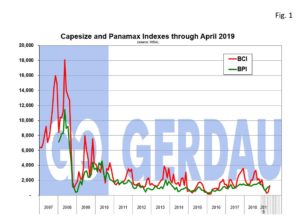

Figure 1 shows the 3MMA for both Capsize and Panamax indexes. These volatile indexes had both been trending higher since early 2016 until this month. The Capsize (BCI), 3MMA fell sharply in February, down 56.1% to 699. It was also down on a y/y metric, falling 45.1%.

Figure 1 shows the 3MMA for both Capsize and Panamax indexes. These volatile indexes had both been trending higher since early 2016 until this month. The Capsize (BCI), 3MMA fell sharply in February, down 56.1% to 699. It was also down on a y/y metric, falling 45.1%.

At Gerdau we regularly monitor the Baltic Dry index since it is a leading indicator of demand for goods on a global scale. An increasing BDI signals stronger global trade which can be good for domestic business if the transactions are fairly traded.